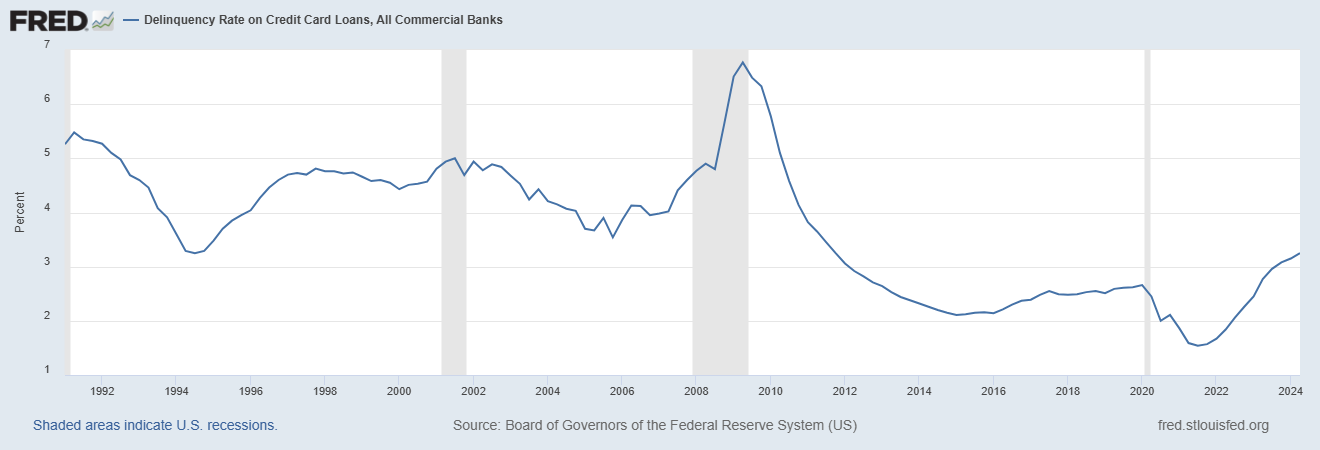

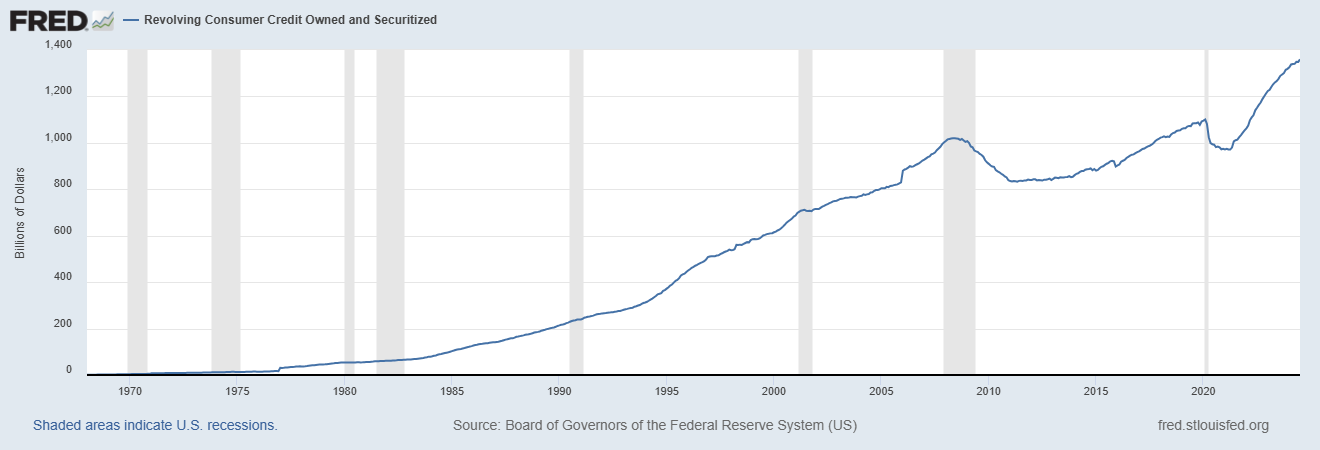

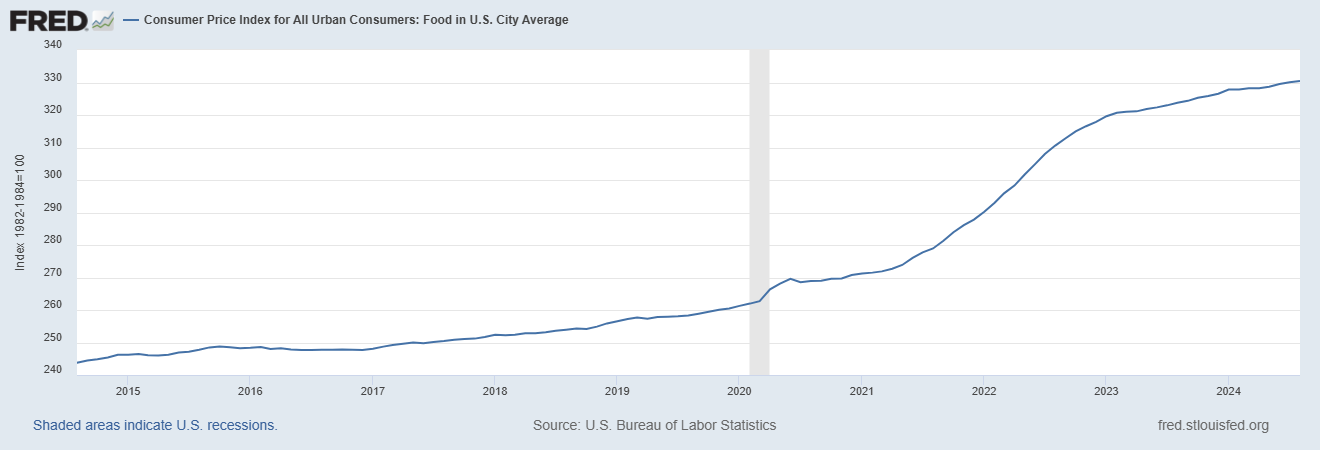

Consumer Credit: The health of the consumer is a critical factor when assessing the likelihood of a recession. Right now, there are signs of increasing stress, as the next two charts illustrate. Credit card delinquencies are on the rise, and revolving consumer credit continues to grow. This suggests that many people are relying on credit cards to cover everyday expenses. These patterns are similar to those observed before previous recessions.

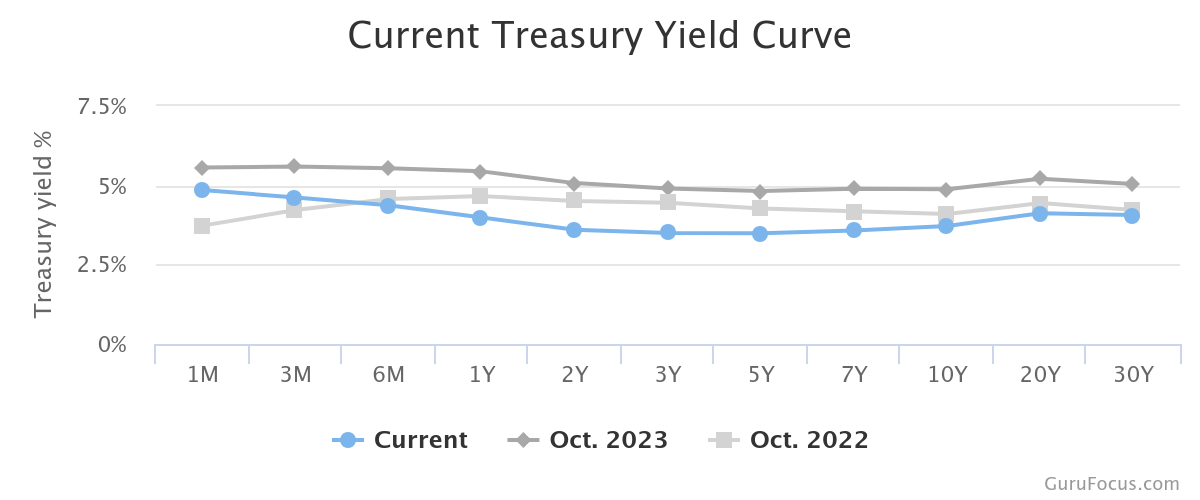

Yield Curve: After more than two years of inversion—where short-term rates were higher than long-term rates—the yield curve briefly uninverted last month, ending one of the longest periods of inversion in history. The yield curve has been one of the most reliable recession indicators over the past 50 years. However, it’s important to note that there is often a significant lag between the inversion and the onset of a recession, and we are currently in that window. Interestingly, as of this writing, the curve has slightly re-inverted again. These are truly extraordinary times, and we will need to closely monitor this indicator moving forward.

Tax Talk

Tax Loss Harvesting

With the onset of the 4th Quarter we will begin to look at Tax loss selling in non IRA accounts as a possible tax saving strategy. A few key bullet points on the process itself:

- Tax-loss harvesting involves selling an investment at a loss in order to offset the taxes resulting from a capital gain.

- Typically, the asset sold at a loss is replaced with a similar investment after a certain timeframe.

- When capital losses are greater than capital gains, investors can deduct up to $3,000 ($1,500 if married filing separately) from their taxable income.

- If net losses for a certain year exceed $3,000, the balance can be carried over and deducted on future returns.

Please keep in mind that any gains or losses are reported on form 1099 DIV at year end for tax reporting purposes.

Rockport News

We continue to grow!!! The past couple of months have seen several new hires at both our Cleveland and Youngstown offices.

Sierra Ryzner recently joined our Youngstown office and will be working initially as a client service associate. She graduated from Youngstown State University, where she completed her degree in December 2021. She recently relocated from Arlington Virginia where she worked in various administrative roles for an accounting firm. When asked about her new position she states, “I am thrilled to be back in my home state and I am grateful for the opportunity to work with such a dedicated team to help clients achieve their financial needs and goals. I look forward to making a positive impact in their financial journeys.”

Tom David has joined the Cleveland office and will be working with clients and on special projects. He is a licensed CPA, a CFP® Professional and holds a Series 65 license as an Investment Advisor Representative. He received a BA from Kent State University and an MBA from Cleveland State University. Tom spent over 10 years in public accounting preparing audits and taxes for small business owners. He also has over 15 years of experience in the wealth management industry in various roles as a client service director, investment advisor, chief compliance officer and chief financial officer with various firms.

Thomas Bell, a recent graduate of Bowling Green State University has joined the Cleveland office as a Paraplanner. He was born and raised just outside London, England but school and golf brought him over to the United States. An All-American golfer at his previous school in Iowa, he transferred to Bowling Green State University to complete his Bachelor’s Degree and play Division 1 Golf.

As always, if you have any questions on anything we have talked about here or anything else that is on your mind, please feel free to reach out.