Jon Arnold’s View Point

The Perspective of Risk

Hope everyone had a great Thanksgiving and are about to enjoy a very Merry Christmas. The title of this brief is “The Perspective of Risk” because it aligns to my/our thoughts on why we are taking a moderate risk gauge on your investments in relation to the current market conditions.

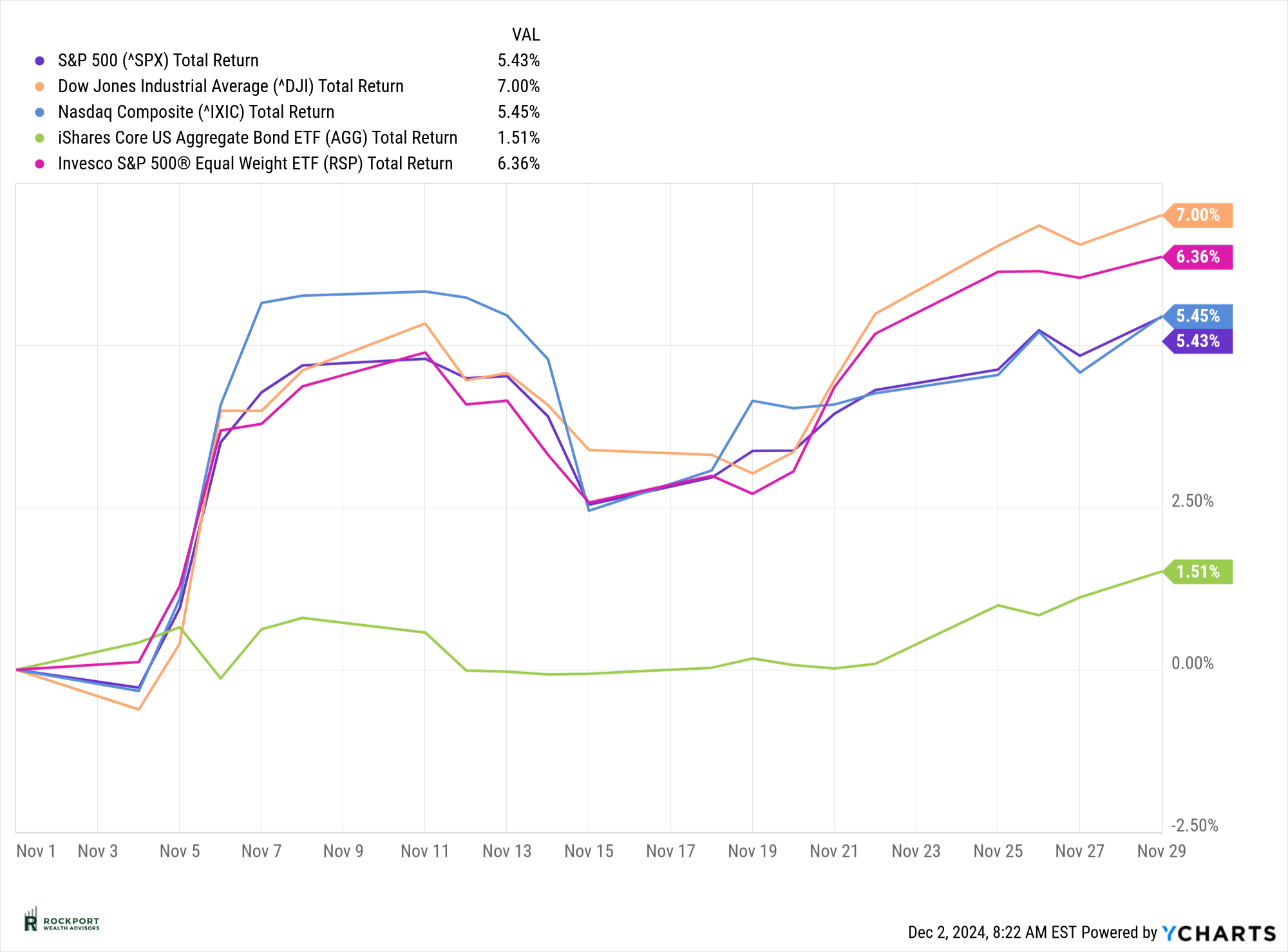

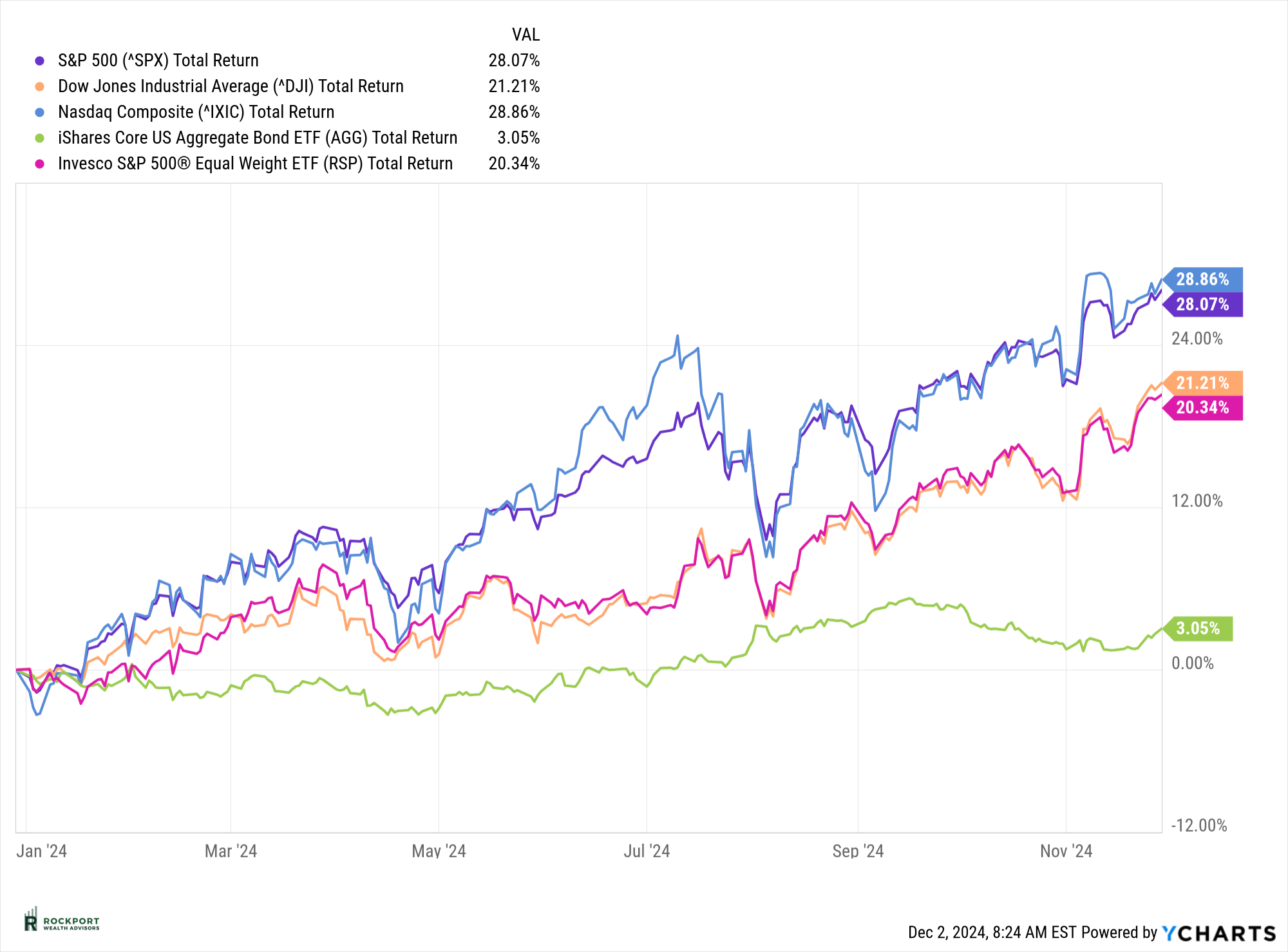

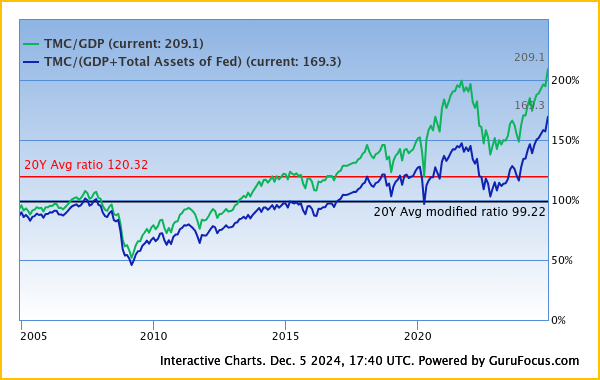

If you look at a 100-year schedule of the stock market you will find that after two double-digit positive returns, the market the following year usually has had a significant negative year to counter the two positives. Look no further than 2020, 2021 and then 2022. The irony of 2022 was when corporate earnings were stronger than 2020 and 2021, yet the end result of the SP 500 was a minus -20.9%. That doesn’t make sense at all. However, it does in my belief system. The efficient market theory of which is something I believe in is that the market is supposed to average 8-10% a year. Therefore, if it averages a combined total of 30% for two straight years, well… you go on to what could be the next year assuming a negative return. The economic basis is not very good to support another positive year as illustrated in charts accompanied by this letter. What I care about is lost money versus lost opportunity. We should end the year at about 15% or a little higher if the current market conditions exist on growth models. However, that would be underperforming the S&P for the year. For the first time in my life, I am trying to underperform the indexes. The answer is very simple to this as the indexes are artificially inflated. I will gladly skip an extra 5% to avoid a -20% counter return.

So that is my perspective of the risk. If you are focused on daily trends or attempting to time the stock market, I would encourage you to seek advice elsewhere. However, If you are interested in a thoughtful, common-sense approach to managing risk while pursuing the potential for long-term, above-average returns, you are in the right place. This investment philosophy emphasizes strategic, disciplined decision-making rather than short-term speculation.

In short, the market has been this way for 100 years and its going to be this way the next hundred. The fundamentals of risk/ reward and buy low/ sell high will always be. To conclude we are going to take a balanced approach until the market cools off and comes back down to earth. Again, lost money is not lost opportunity. Let’s do everything we can not to lose this decent gain we have for 2024.

On more of a personal note, I sincerely wanted to wish you a very Merry Christmas and tell you from the bottom of my heart thank you so very much for your trust and business. Please reach out for any questions or concerns. I am a blessed guy to be in your life.

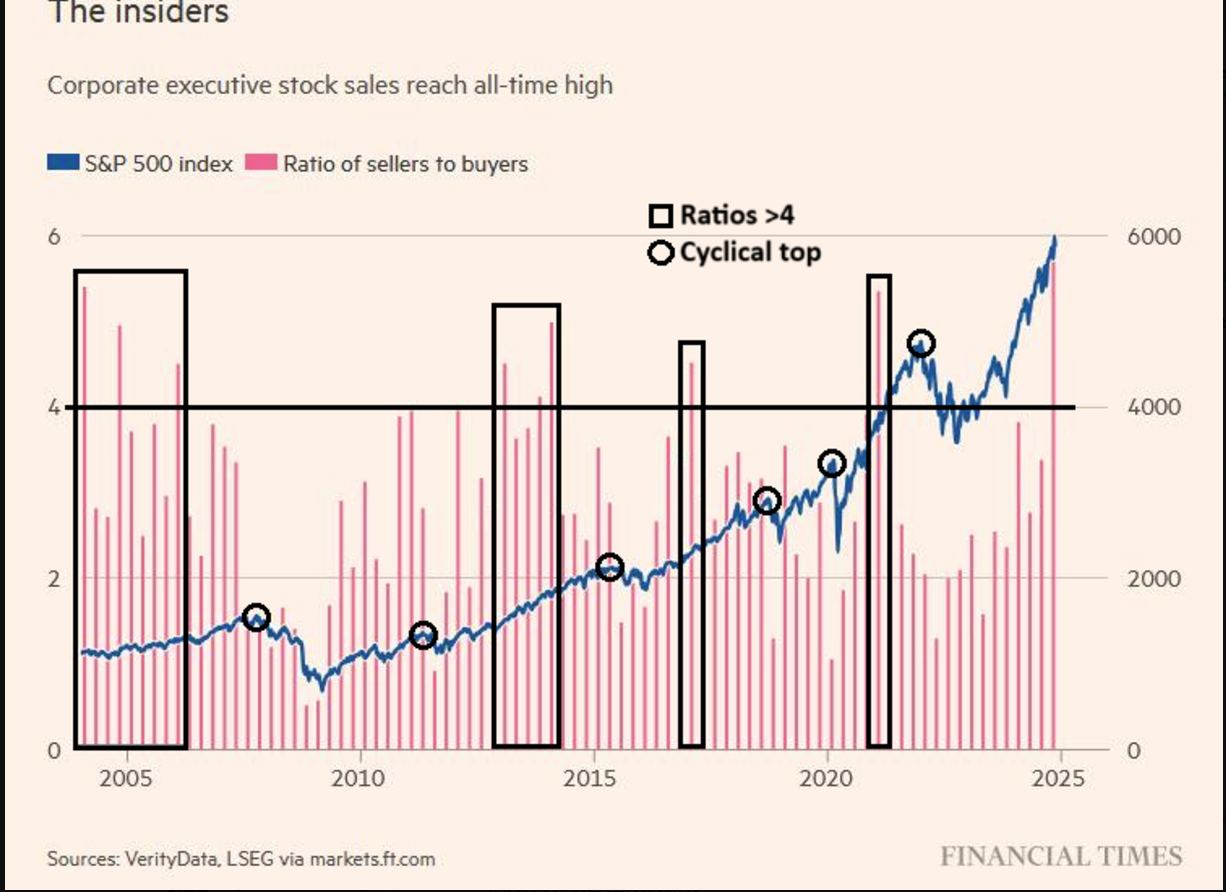

Corporate executives are often well-informed about the true value of the companies they lead and have historically served as reliable indicators of future stock price movements. They tend to buy shares when they believe the company is undervalued and sell when they feel it’s overvalued. Right now, the ratio of insider selling to buying is at its highest level in over 20 years, with executives taking advantage of favorable conditions to cash out.

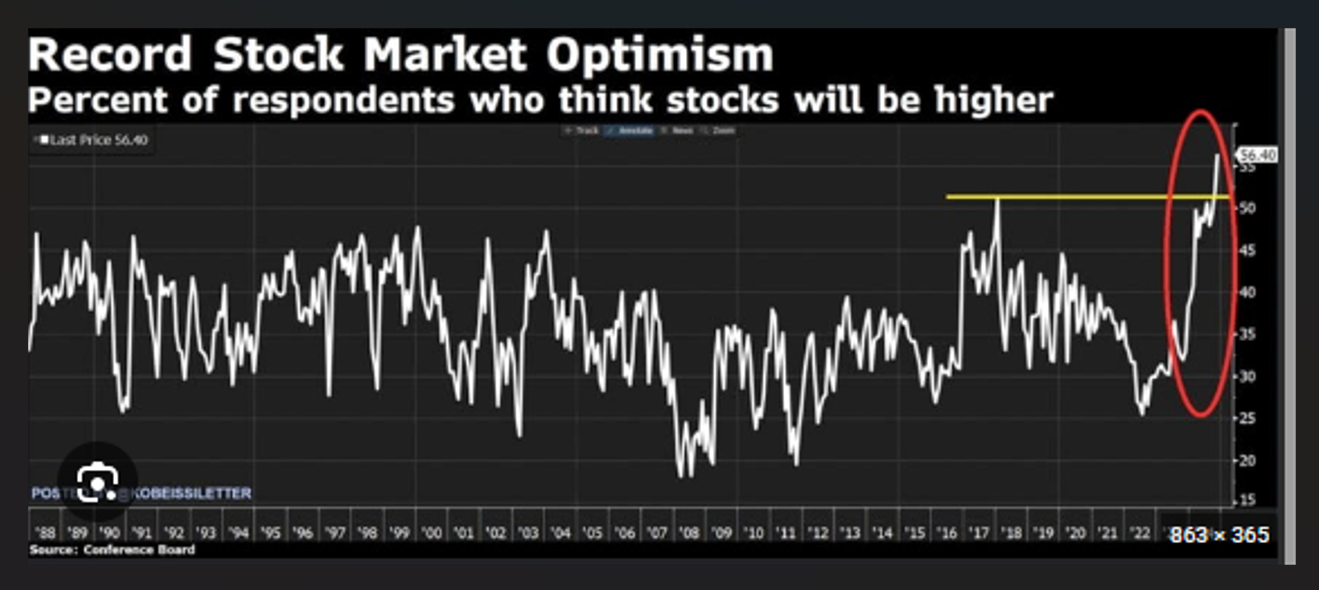

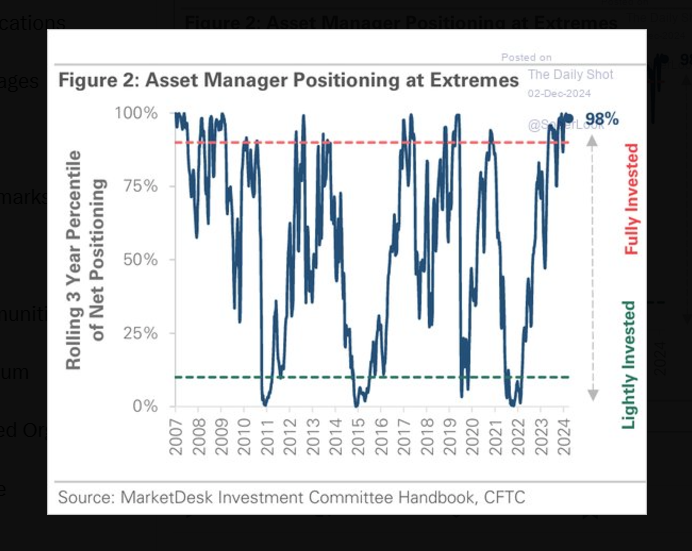

Another indicator we’re closely monitoring is asset manager positioning, which shows that professional managers are fully invested at this stage. Similar to the bullishness chart, you can see that high readings have often preceded periods of market decline, like in late 2021. These managers, like many investors, can be driven by emotion and fear of missing out on anticipated gains. Historically, such high levels of optimism are often seen near market peaks. We’ll be watching closely to see how this develops.

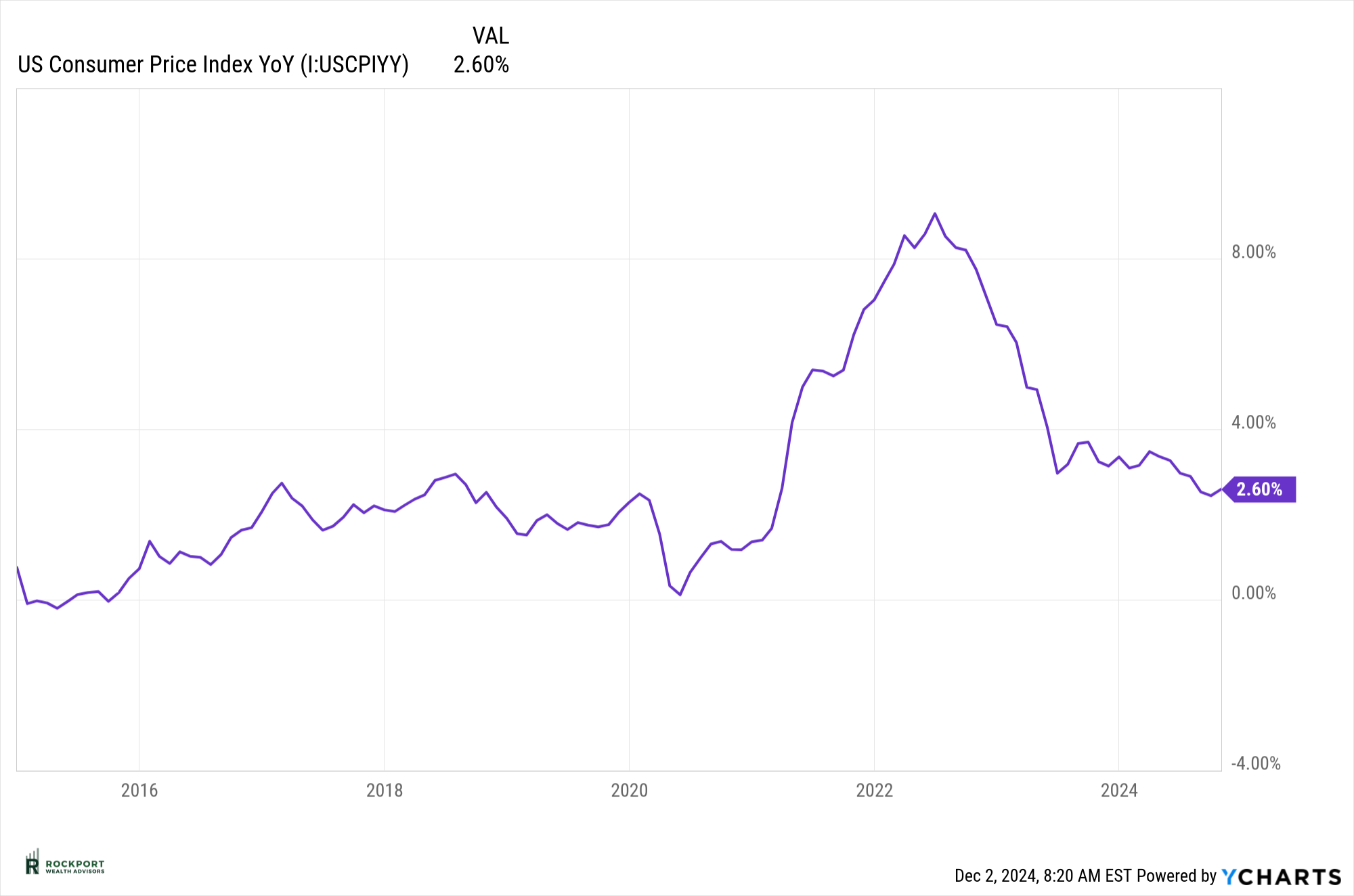

Unfortunately, inflation seems to be on the rise again, which could dampen the Fed’s outlook on future interest rate cuts. As you may recall, we removed our inflation charts several months ago as we saw a steady decline, with inflation moving closer to the Fed’s 2% target. However, recent months have shown a slight uptick, indicating the trend may not be as clear-cut. Adding to the uncertainty, the Fed continues to send mixed signals. For instance, in July, they suggested that rate cuts weren’t necessary, but by September, they had implemented a 0.50% rate cut. Such a significant policy shift in such a short time frame highlights their reactive approach to current data, rather than a forward-looking strategy. This tendency to adjust based on recent developments has historically made it challenging for the Fed to set effective monetary policy.

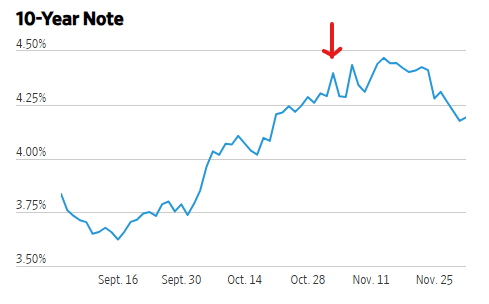

On a more positive note, the 10-year Treasury note, which we highlighted last month, has declined from nearly 4.4% to just under 4.2% (as indicated by the red arrow in the chart). This is encouraging, as this rate directly impacts many borrowing costs. Furthermore, with the 10-year Treasury approaching 5% a month ago, it would have posed greater competition for stocks. We’ll continue to monitor this closely to see if the downward trend persists or if rates begin to climb back toward 4.5-5%. A continued decline would be a welcome development.

Wall Street, much like many aspects of life, often operates with a “nothing matters until it matters” mindset, and right now, it feels like nothing is truly making an impact. However, at some point, the market will latch onto something it doesn’t like and react accordingly. Historically, this tends to be something that isn’t on investors’ radar at the moment, which can catch the market by surprise—and as we know, the market doesn’t like surprises. Good luck predicting what that might be.

Lastly, as the year winds down, it’s also the time when major investment firms release their year-end targets for the S&P 500. Not surprisingly, most of these targets are higher—apparently, the market only ever goes up! The S&P 500 sits at 6032 as of December 1st. For your reading pleasure, here’s a list of the published S&P 500 targets for 2025:

Bank of America 6,666

BMO Capital Markets 6,700

Deutsche Bank 7,000

Evercore ISI 6,600

Goldman Sachs 6,500

Morgan Stanley 6,500

UBS 6,600

Yardeni Research 7,000

Almost everyone is projecting at least a 9-10% increase from current levels! However, given the unpredictable nature of financial markets, even the price targets set by some of Wall Street’s most trusted names are likely to be imperfect. So, it’s important to approach these forecasts with caution.

Rockport News

More on scams to avoid…

With the Holidays upon us there will be no shortage of unethical individuals trying a variety of ways to scam consumers. Below is a an excerpt and a quiz from AARP website that we felt would be appropriate to share. Take a few minutes to try the quiz to test your knowledge on scams and safe shopping during the holidays.

Scams have become a part of our everyday lives unfortunately. Between the phishing emails and texts from people pretending to be government officials or online retailers needing your personal information and robocalls warning of money owed, it can be exhausting. And these criminals don’t rest during the season of goodwill. In fact, they seem to work even harder to perpetrate fraud, according to a new AARP Fraud Watch Network report.

The AARP survey of 1,869 U.S. consumers age 18 and older, detailed in the report, “Holiday Fraud: Scammers Continue to Steal Holiday Cheer,” finds that in the past year 82 percent of U.S. consumers have experienced or been targeted by at least one form of the fraud that is rampant during the holidays, including requests from (often fake) charities, online shopping scams and fraudulent communications about delivery problems. About the same percentage of older adults (age 65 and up) report having experienced or been targeted by holiday-related scams last season (80 percent vs. 78 percent, respectively).

The survey included a fraud knowledge quiz (see questions below), where only 28 percent of respondents answered seven or more of the 10 true-or-false questions correctly.

“We see two important findings in this year’s survey,” says Kathy Stokes, director of fraud prevention programs at AARP. “One is that fraud is still rampant, and the other is that our knowledge of how to stay safe isn’t improving.”

Highlights from the survey:

- Fifty-six percent of respondents have received a notification from someone saying they are from the U.S. Postal Service, FedEx or UPS about a shipment issue, and it turned out to be fraudulent. That’s up from 29 percent in 2022.

- Twenty-five percent of respondents have had a package stolen from outside their doors.

- Thirty-five percent received a donation request in the past year that seemed fraudulent.

- Thirty-five percent have experienced fraud when trying to buy a product through an online ad.

- Twelve percent of travelers experienced fraud when booking a trip.

- More than 1 in 4 (29 percent) have given or received a gift card with no balance.

- Most (90 percent) agree that lawmakers need to do more to protect consumers from fraud and scams.

Gift cards are a favorite holiday item for giving and receiving, but they are also a favorite among fraud criminals. According to Stokes, “The survey found that 29 percent of consumers have either given or received a card with no value on it. While some of this could be error, much is likely low-tech in-store manipulation of cards or high-tech tracking of card values online and draining them.”

Test your safe-shopping savvy

Survey participants were asked the following questions. See how you do.

True or false?

- Online retailers like Amazon and eBay will request your login information to provide customer support.

- Ordering a free trial offer from an online retailer (with a small shipping charge) is a good way of trying out a product before you buy it.

- Peer-to-peer payment apps like Cash App, Zelle and Venmo have the same consumer protections as your credit card.

- When searching online for customer support, the first customer service phone number that appears on your search results will connect you with a legitimate person from that company.

- Peer-to-peer payment apps like Cash App, Zelle and Venmo are only intended to be used to transfer money with people you personally know, like family, friends, the babysitter or the lawn service.

- It’s safe to pay for a vacation rental found on apps like Airbnb or VRBO outside of the app — for example, sending money with a P2P app instead.

- Ads for merchandise that you see on social media, such as Facebook or Instagram, or other places online are trustworthy.

- The safest way to make purchases online is with a credit card.

- Regularly updating software on your devices provides protection against fraud.

- If you are directed to send someone money by converting cash to cryptocurrency at a convenience store kiosk, it is a scam.

Answers, with the percentage of respondents who answered correctly: 1. False (36); 2. False (40); 3. False (36); 4. False (45); 5. True (61); 6. False (51); 7. False (51); 8. True (56); 9. True (61); 10. True (62). Explanations of these answers are available in the report. (Source AARP)

As always, if you have any questions on anything we have talked about here or anything else that is on your mind, please feel free to reach out.