Jon Arnold’s View Point

Before we get into a review of the month of March, I want to remind everyone that we are always watching closely the economic and stock market news and movements that are occurring. While making changes during this extremely volatile early April may seem like the correct emotional thing to do, reacting to short term movements is not the wisest strategy. We will continue to evaluate and make any changes to models as warranted. As previously mentioned in our newsletters and webinars, we have been positioned defensively since December. Again, thank you for your trust and patience as we navigate this financial journey together.

|

Below please find some market analysis from the team at Rockport Wealth Advisors. |

|

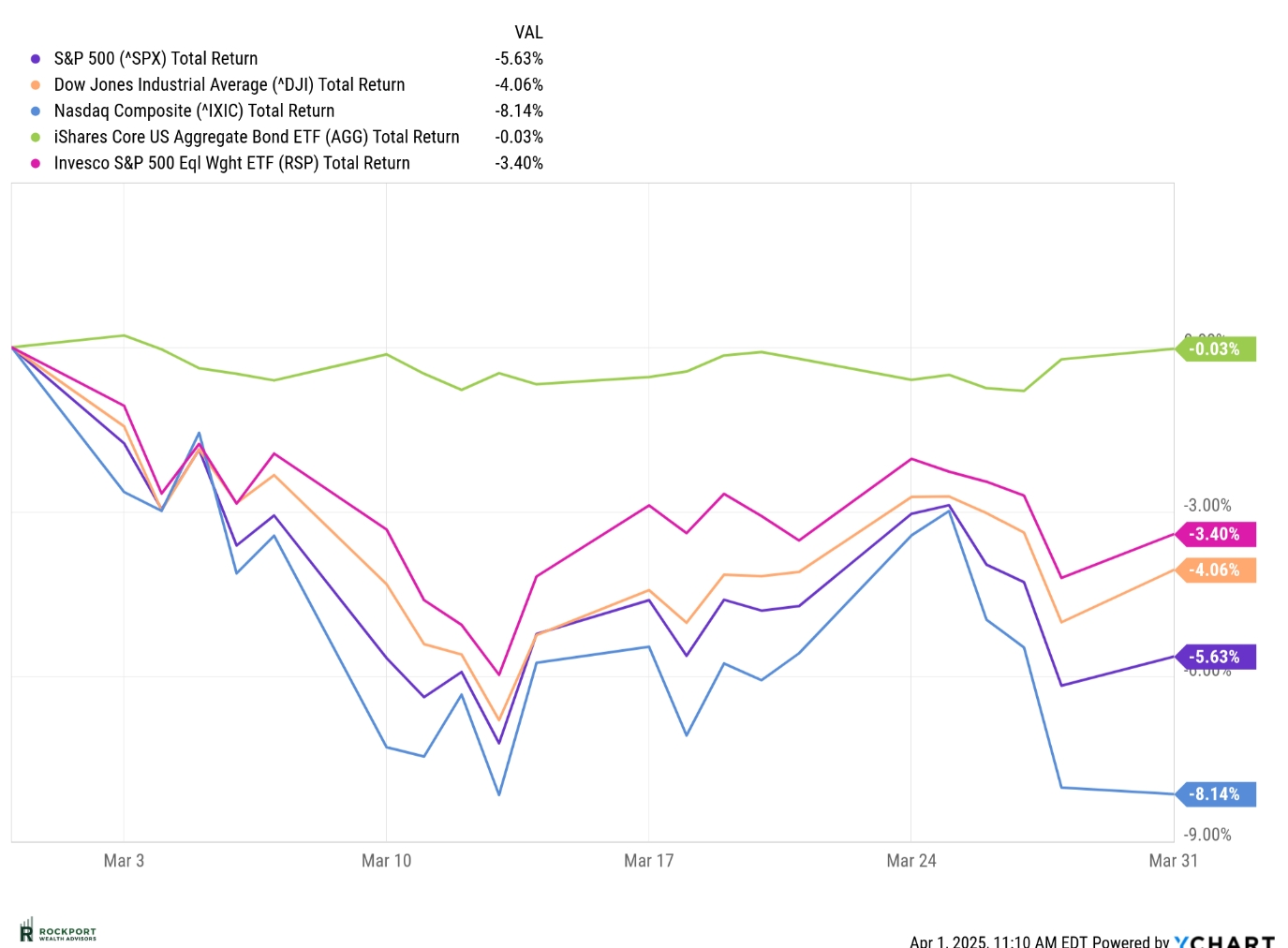

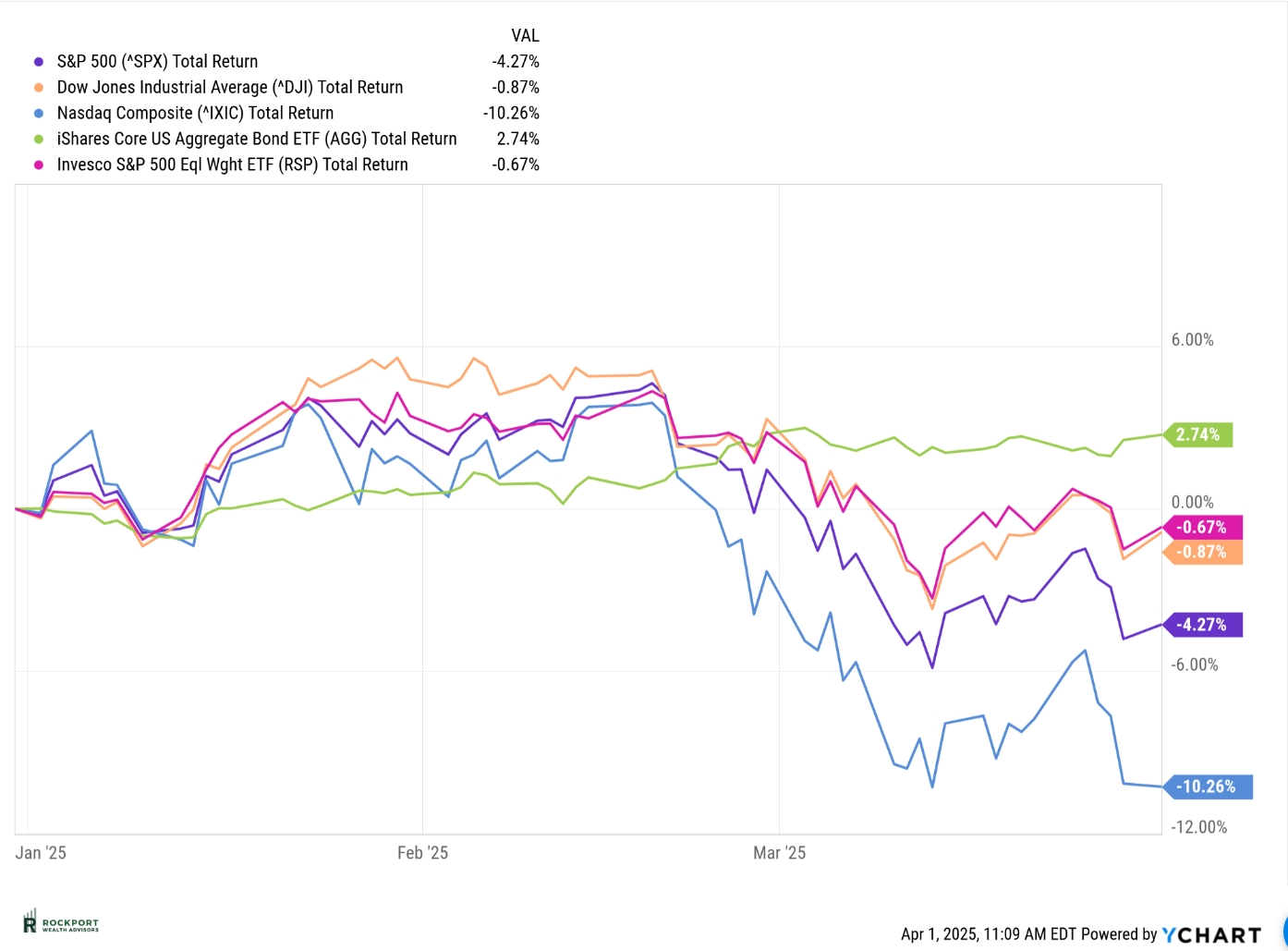

Markets & Economy We expected heightened market volatility, and March certainly lived up to that expectation. The S&P 500 fell by 5.63% for the month, pushing it into negative territory for the year with a decline of 4.27% through the first quarter of 2025. During the month, the S&P 500 briefly entered and exited correction territory—defined as a 10% drop from recent highs—twice. To say the least, it was a month of volatile trading. Other major indexes also struggled, with the NASDAQ seeing a steeper decline of 8.14% in March. This index, which has been the hardest hit so far this year, is now down 10.26% year-to-date. The primary factor behind this weakness remains the performance of the “Magnificent 7” stocks (such as NVDA, GOOGL, MSFT, AAPL, AMZN, and others), which have experienced even sharper pullbacks than the broader index. The Dow Jones Industrial Average and the S&P 500 Equal Weight Index fared relatively better but still experienced declines of 4.06% and 3.40% for the month, respectively. Year-to-date, the Dow is down 0.87%, while the Equal Weight S&P 500 has fallen 0.67%.

|

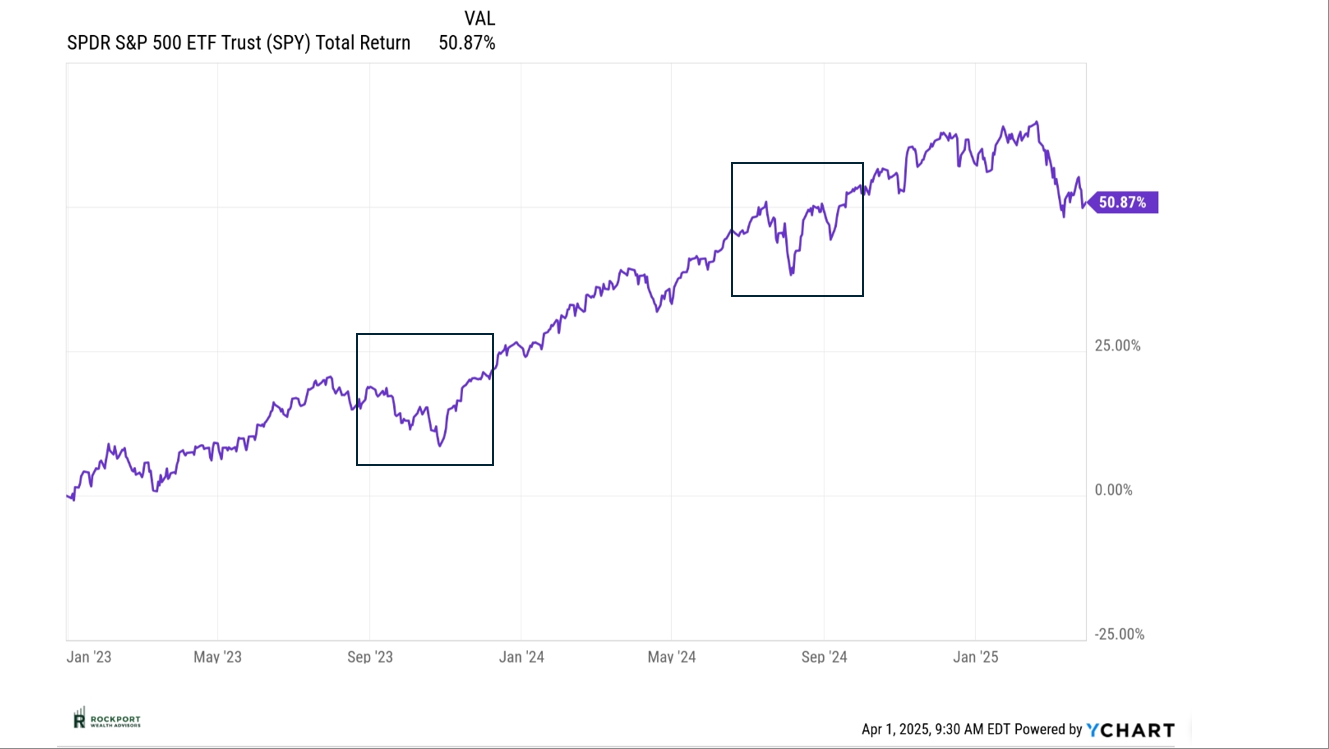

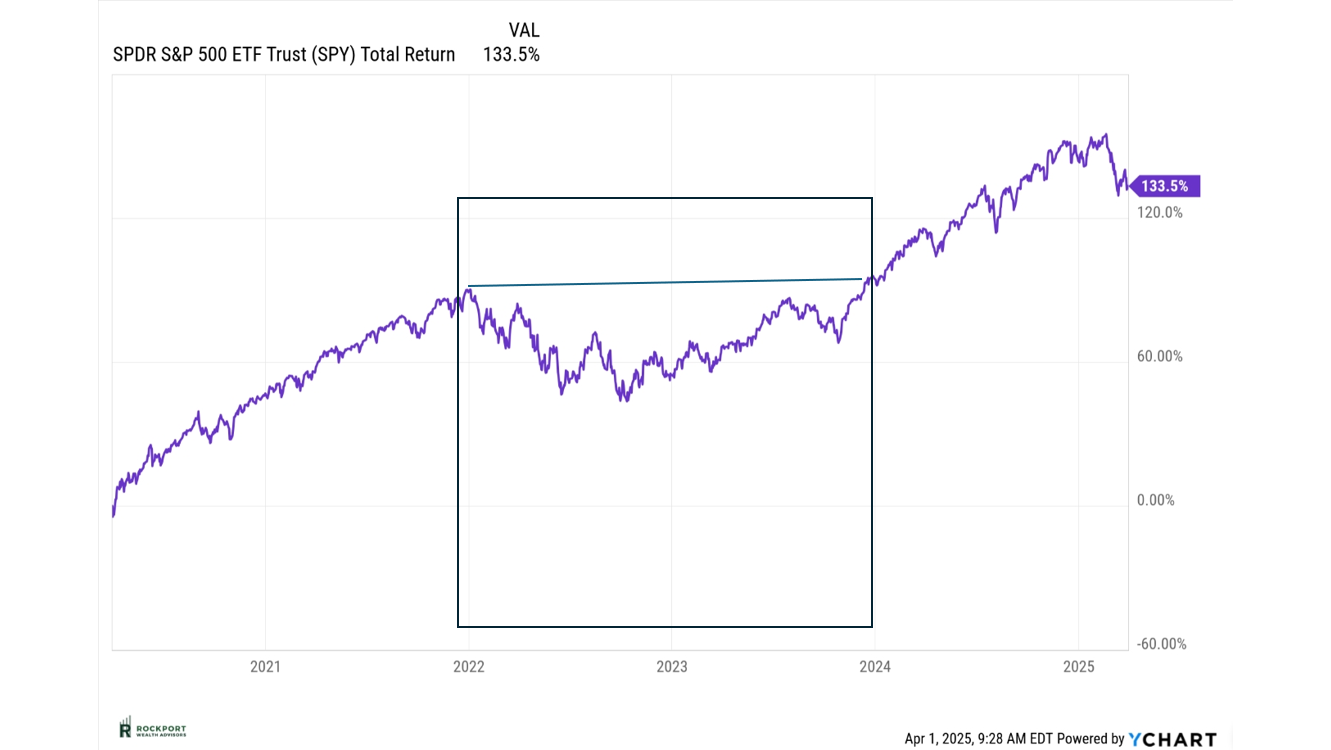

A couple of stock market-specific notes to highlight: March marked the 5-year anniversary of the end of the COVID market decline. It’s hard to believe it’s already been five years since that entire ordeal. The first chart below shows the S&P 500 from the March low. Despite the recent downturn, the market has experienced an impressive rally, with a mid-cycle pause starting in 2022, as indicated by the marked square. The second chart highlights two other declines of similar magnitude to this year’s, occurring in 2023 and 2024, also shown in the squared areas. It’s important to keep these past events in mind when encountering the alarming headlines generated by the media. During those times, the headlines were just as, if not more, troubling for many.

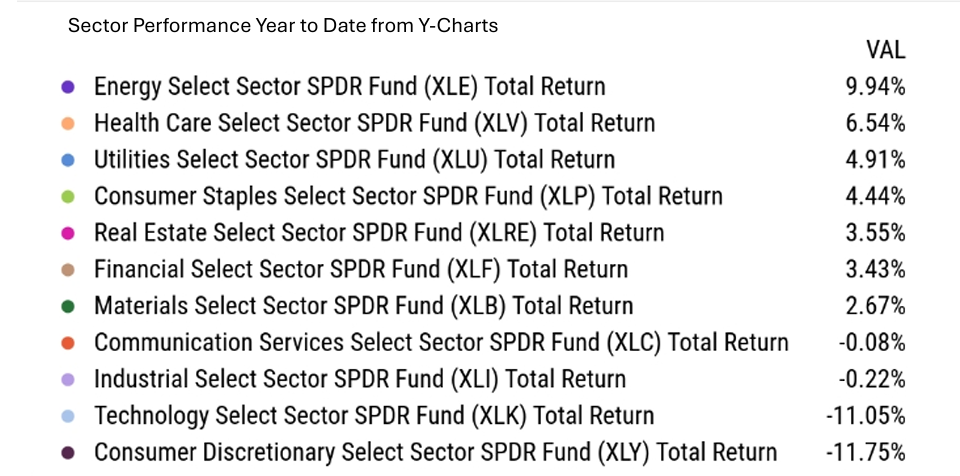

So, where does this leave us? While the indexes are in negative territory for the year, some sectors are still showing positive returns year-to-date. Look at the sector chart below, this particular decline hasn’t been across the board. It’s important to be cautious when interpreting the news, as what’s being reported may not align with your personal situation. Much of the decline has been concentrated in the “Magnificent 7” stocks and other high-flyers from a year ago. The more exposure you’ve had to these stocks—many of which are down over 20% from their highs—the more your portfolio may be affected. So far in 2025, diversification has played a critical role in mitigating losses.

Looking ahead and updating some key charts, we will focus on inflation, consumer confidence and sentiment, employment, and interest rates—factors that will be crucial in determining whether the economy faces a slowdown or an actual recession in the coming months.

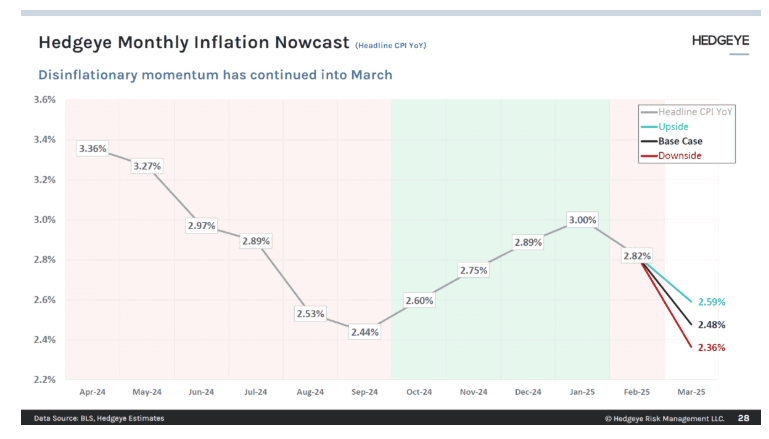

Inflation took a pause in February, as shown in the CPI (Consumer Price Index) chart below. March data won’t be available until April 10th, but as we noted last month, inflation appeared to be cooling, and that trend continued. This is positive news, but it’s increasingly likely that inflation could re-accelerate into May, June, and possibly through the rest of the year. Our friends at Hedgeye, one of our go-to data sources, project a decline in March inflation, followed by an acceleration thereafter. Additionally, any tariffs implemented could certainly impact inflation, and given the current uncertainty surrounding them, forecasting is especially challenging.

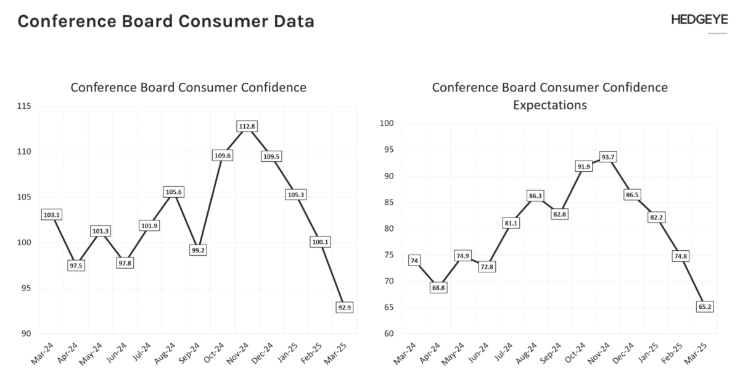

Consumer confidence has declined for the past four months, along with future expectations for consumers. Rising concerns over tariff-driven price increases, interest rates staying higher for longer, and the ongoing risk of a recession are continuing to undermine consumer optimism about future income and employment. This trend is commonly observed when the economy slows, often marking the early stages of a recession.

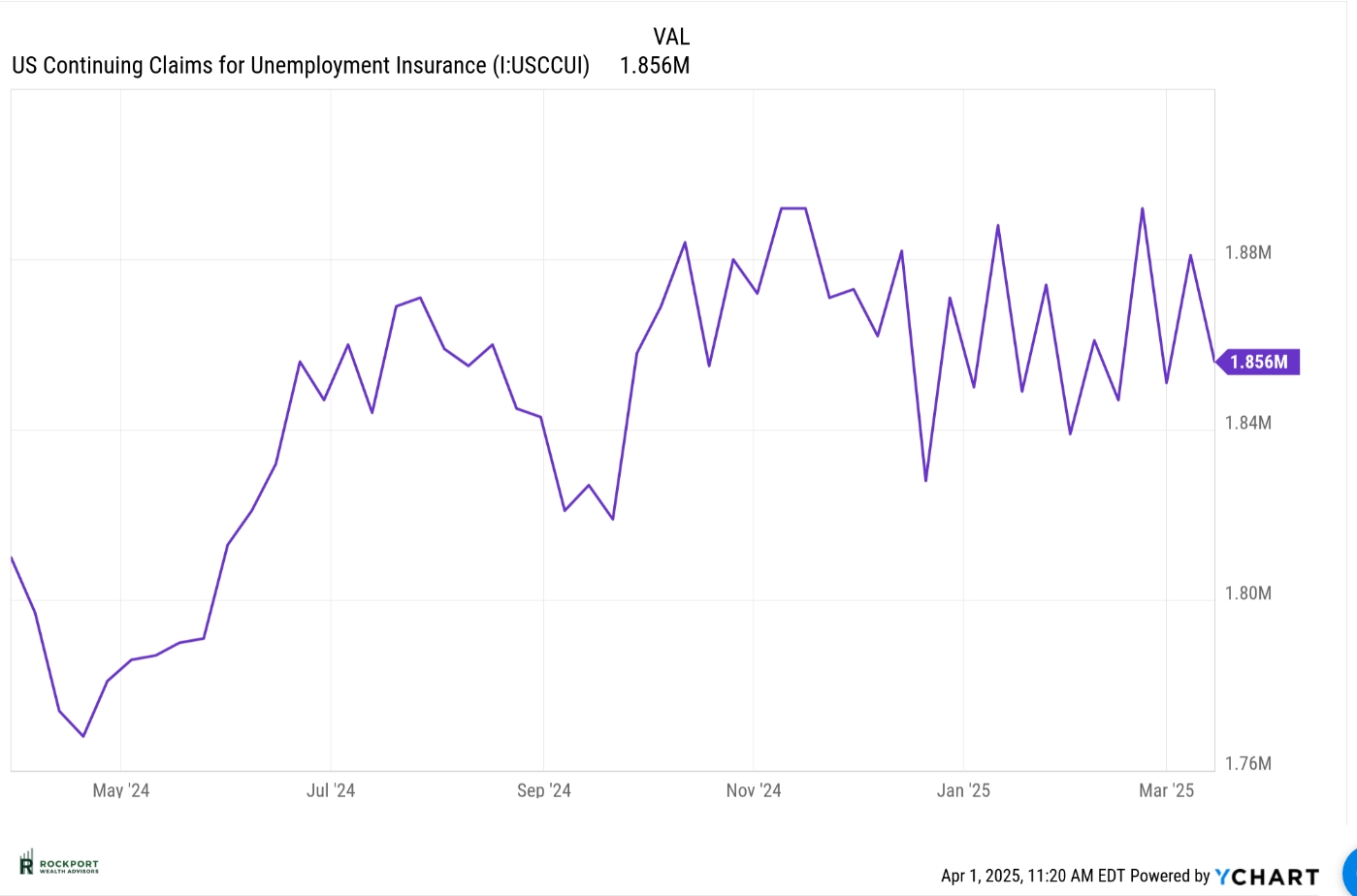

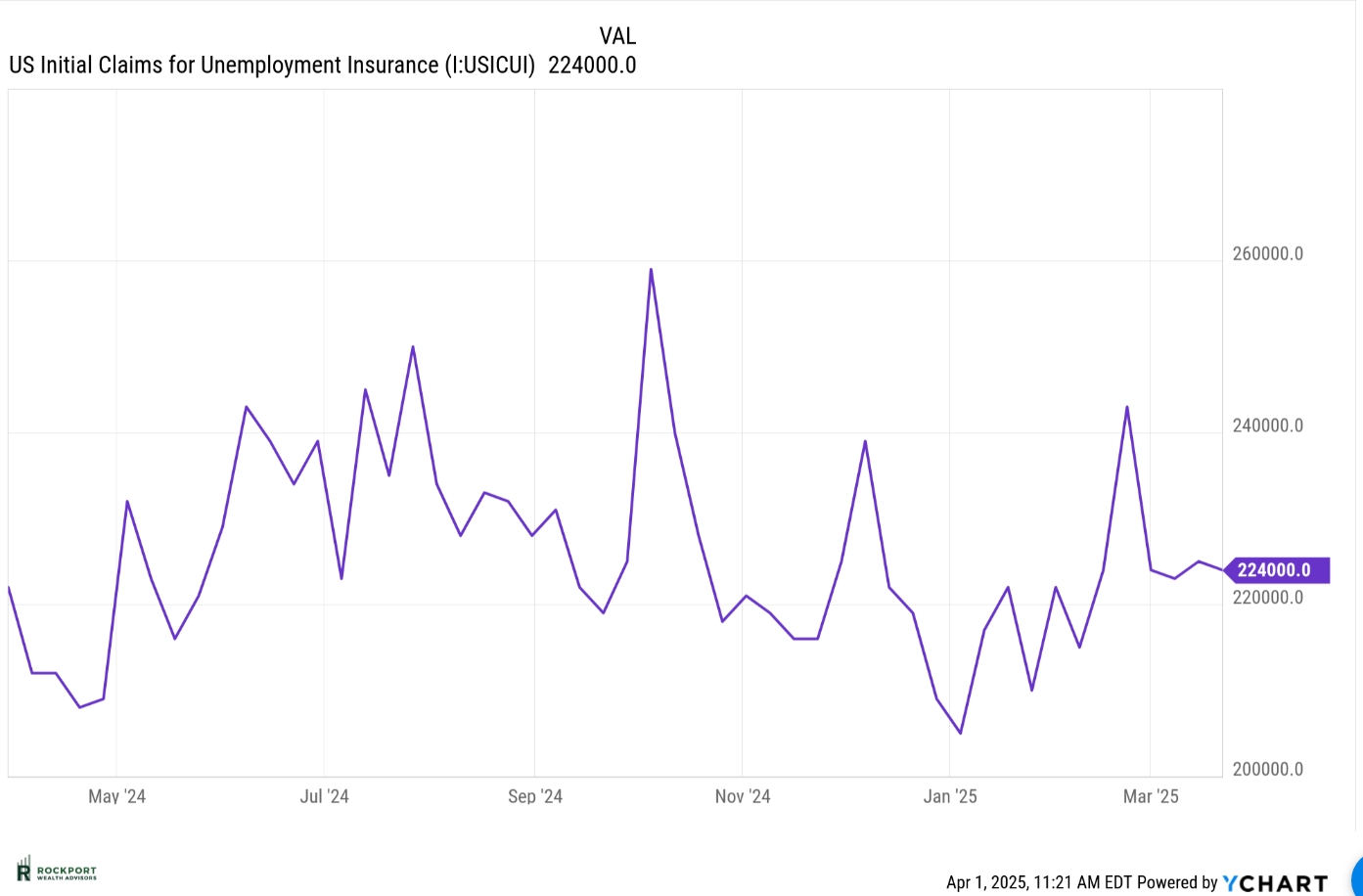

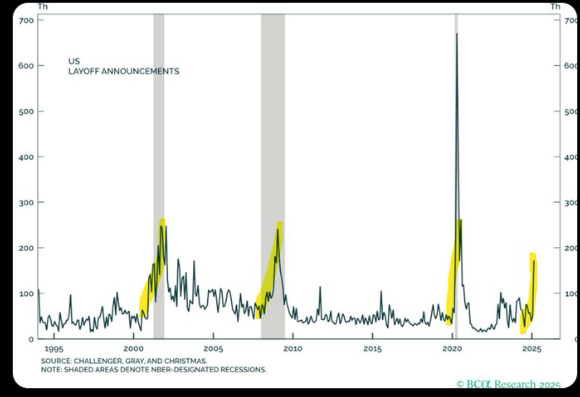

Employment will remain a key factor moving forward. Both continuing and initial claims for unemployment are currently in check and not spiking. However, it will be important to monitor these charts in the coming months, especially given the recent rise in layoff announcements, which are typically seen during recessions.

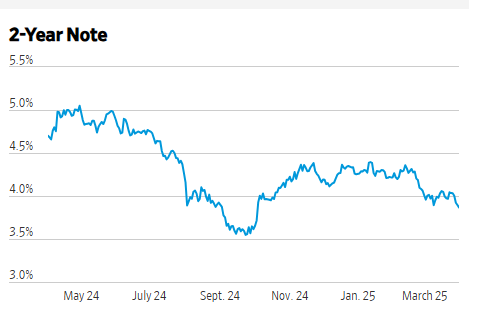

Updating the 2-year Treasury yield chart from last month, we see that the yield has continued to decline and is now below 3.9%. As we noted earlier, this provides the Federal Reserve with more room to cut interest rates, and there’s a possibility of 3-4 rate cuts this year. However, inflation trends will also play a significant role in guiding the Fed’s decisions, so stay tuned. The next Federal Open Market Committee (FOMC) meeting is scheduled for May 6-7, just a month away, when they will decide on rates.

As a reminder, the primary reason the Fed cuts interest rates is to stimulate the economy and encourage growth. Given the current situation, this may become necessary, but the persistence of inflation makes these decisions more complex and challenging.

To wrap things up, uncertainty remains extremely high right now, though this is not new news. The stock market thrives on knowing the lay of the land, and unfortunately, that’s been somewhat elusive in the first quarter of this year. The markets are craving clarity, and perhaps we’ll get that in the coming weeks. While many data points have slowed and the media is calling for a recession, having been through this for as long as we have, we know that no outcome is ever certain. As mentioned earlier, we’ve faced similar alarming headlines before—such as in 2020—not too long ago, and as the charts show, the eventual outcomes were quite different from what those headlines suggested.

We will continue to position assets in a way that reflects the current environment, which has been defensive, and that strategy has been working. Eventually, calmer heads will prevail, and buying opportunities in growth stocks will emerge—opportunities we may be able to capitalize on.

As always, if you have any questions on anything we have talked about here or anything else that is on your mind, please feel free to reach out.