|

For those that were in the viewing area, we hope everyone had a chance to view and enjoy the eclipse. It truly was an incredible sight to see.

|

Jon Arnold’s ViewpointWe recently had a meet and greet with our new partners at Rockport Wealth and I am happy to report it was an amazing success. Joe Kovach, Adam Stalnaker and the two offices came together to meet clients and answer questions about the merger and an update on market commentary. I did most of the market commentary combined with Senior Executive of First Trust Exchange Traded funds Greg Wearsch to talk about the challenges and possible strategies for the upcoming year. The feedback was better than expected and more than anything it calmed people’s nerves to know that I was not going anywhere and more importantly the new teammates are awesome people. I can also tell you many people made the call the next day to sit down with Rockport Wealth to learn about how they can strengthen their financial wellbeing with what they bring to the table. Overall, the result was beyond my expectations. If you have not scheduled a time to meet Adam or Joe, or both do yourself a favor and do so, as you will really be pleasantly surprised. Meanwhile I am going to continue to manage assets and see you as you request. For those that were unable to attend please click the link below to see a review of the presentation and some photos from the event. |

|

On that note, I am going to dig into what I am seeing now and where I think the market is headed. The first thing I can note is the VIX (that is the fear gauge of the market) has shot up like a bottle rocket over the last five trading days. This could be because the market is above its usual return for the year in the first quarter or it could be something bad is around the corner. Here are some heavy unnerving facts that have me concerned.

Credit Card defaults have hit an all time high as of this morning. Foreclosures are really starting to ramp up. Used car repossessions are increasing by the month. Underwriting on home loans is getting stricter and more difficult and of course home goods are up in price 58% since 2020. However, let me dig into something deeper that I am noticing and that I’m in touch with.

Pawn shops are busier than they have ever been and when I investigate why, it is because people are pawning various things just to buy groceries and pay for their utilities. Restaurants are increasing their prices dramatically while giving less on portions and using fewer quality ingredients. Retail stores are decreasing administrative staff causing very long frustrating lines knowing they could lose customers. The big wow for me is Apple laying off workers. Apple is a company that has more cash on hand than many countries. That is a very tough pill to swallow. Overall, what I am saying is people are running out of money.

Our stance on allocation is this. Corporate profits last quarter were excellent, and the market keeps chugging along against common sense. Therefore, we remain in very diversified and boring allocations such as the S&P 500 and Nasdaq indexed funds and the Schwab Money Market paying a weekly yield ranging from 5.15-5.20% a year. It’s boring but it does the job. Please note my finger is on the trigger to go completely money market at the slightest hint of extreme market volatility. The next 4-6 weeks of quarterly reports from companies will be the tale if something bad doesn’t come by before then. Overall, what I am saying is we are in a position to make some decent money without a lot of major risk knowing if things fall apart fast, your investment portfolio won’t fall apart fast with the market. When risk is on our side, please note we will take that on to match your investment tolerance. Until this happens boring is where we will stay. In closing I will be by phone anytime that you need to talk or have a concern. Please call the office to make an appointment and we will discuss your portfolio and take care of business as you see fit. I really enjoy discussing investments with our clientele. Below you will find some market analysis from the team at Rockport Wealth Advisors. |

|

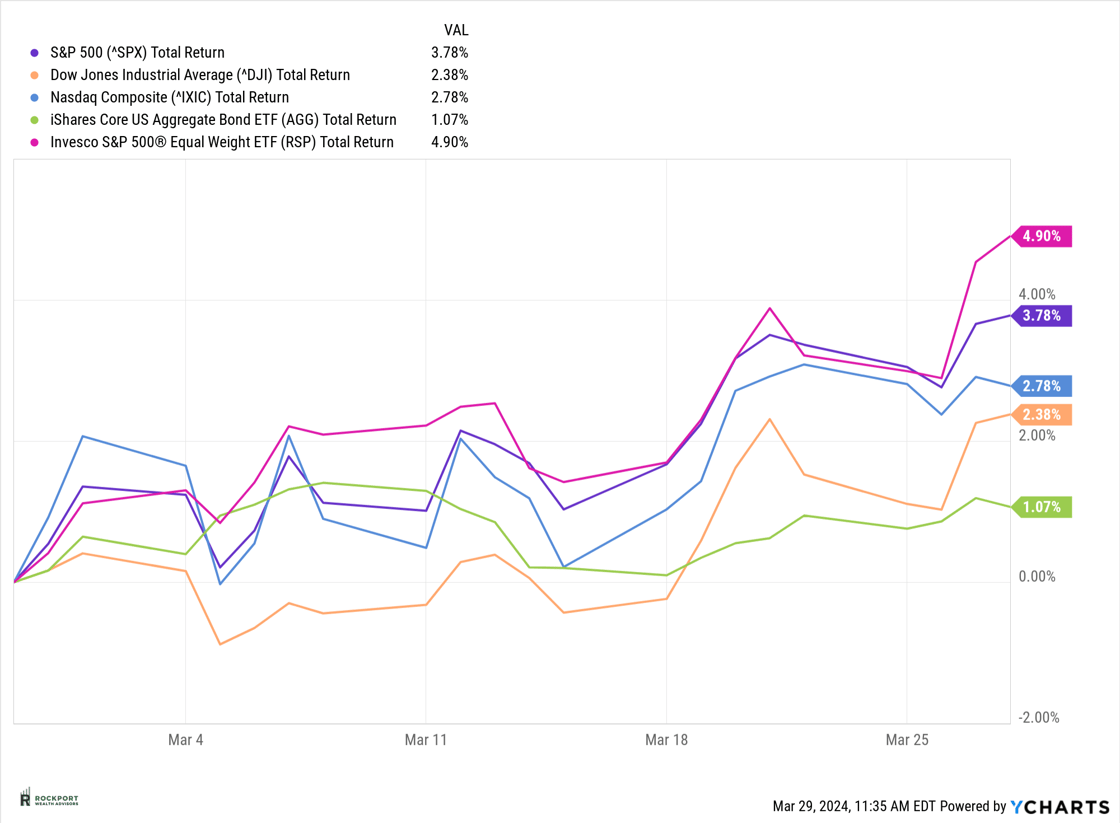

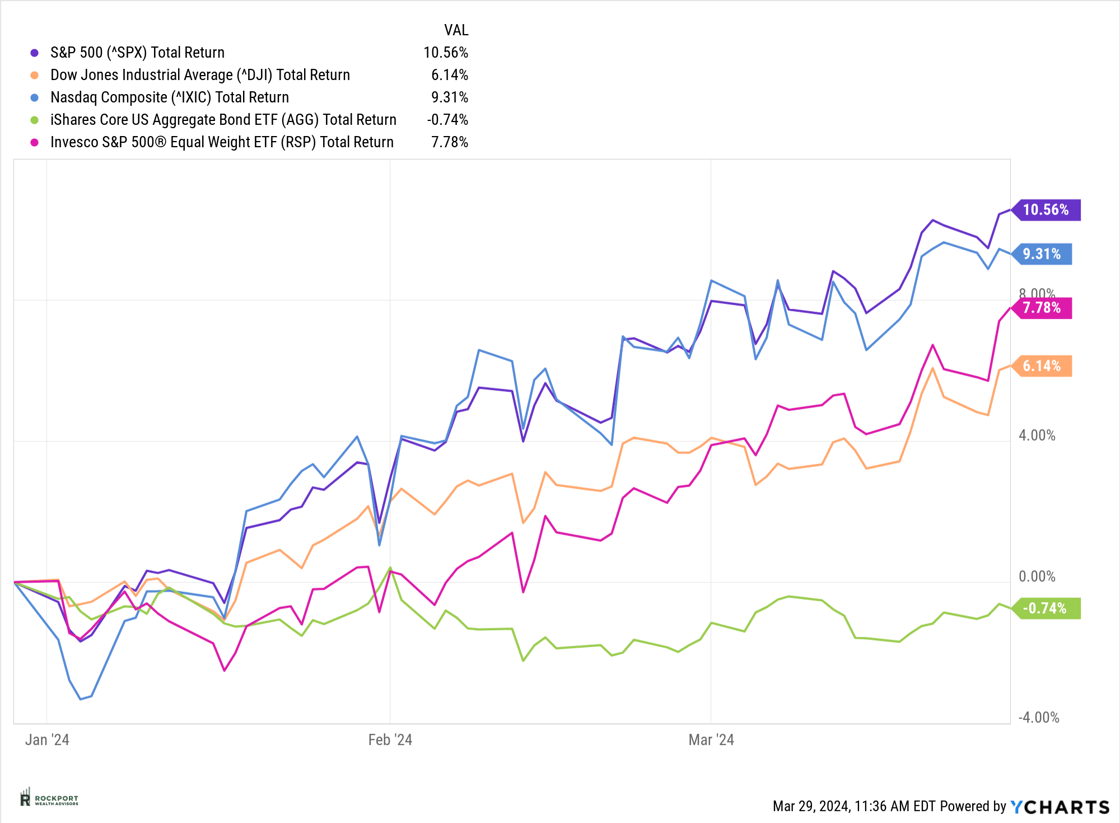

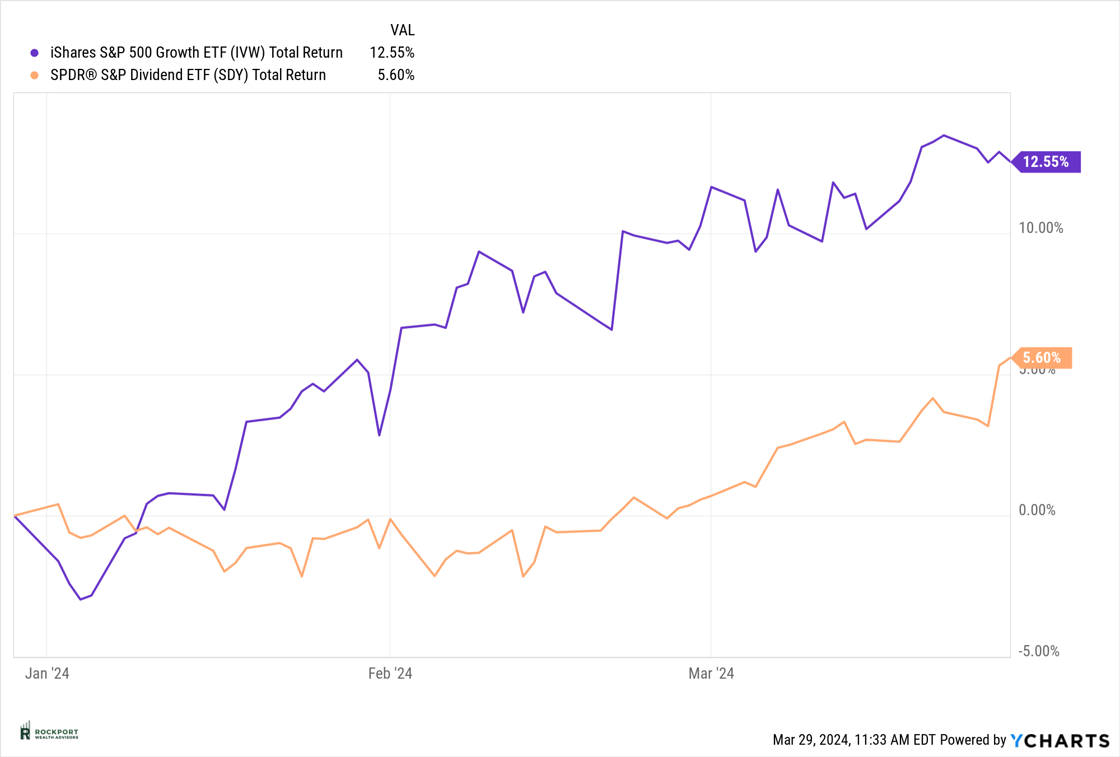

Markets & Economic Analysis As we wrap up the first quarter of 2024 and enter the second, markets continue to maintain high levels. The S&P 500 rose by 3.78% for the month and is now up by 10.56% for the year. The stock market’s resilience is truly remarkable at this point, surprising not only us but also many Wall Street experts, with five consecutive months of gains. As we mentioned last month, there seems to be a disconnect, as many traditional indicators of both recession and stock market valuation are seemingly being disregarded. Perhaps the takeaway is that stocks often follow their own path, and many economic or market issues, whether real or perceived, don’t become significant until they do. Based on past patterns, at some juncture, the markets will start paying attention to these indicators again, and they will once again become relevant. |

|

|

|

|

One compelling illustration of the stock market’s overvalued state is by observing the actions of major players. Warren Buffett’s Berkshire Hathaway, for instance, currently holds a record $167 billion in cash. This signals their view that stocks are overpriced at these levels. Additionally, several CEOs of major corporations have been selling their company stock to capitalize on the exceptionally high stock prices. These actions speak volumes about the current market conditions.

As April comes to a close, so does the most historically positive seasonality period for stocks, spanning from November through April. There’s a well-known adage on Wall Street: “Sell in May and go away.” This doesn’t necessarily mean that stocks will decline during this period, but historical data shows that returns have typically slowed down. If a market pullback were to occur, the summer or early fall would be the logical time. It’s important to remember that the market tends to experience at least one decline of 10% or more per year, regardless of whether the overall year ends positively or negatively. Recall the period from August to October last year for an example.

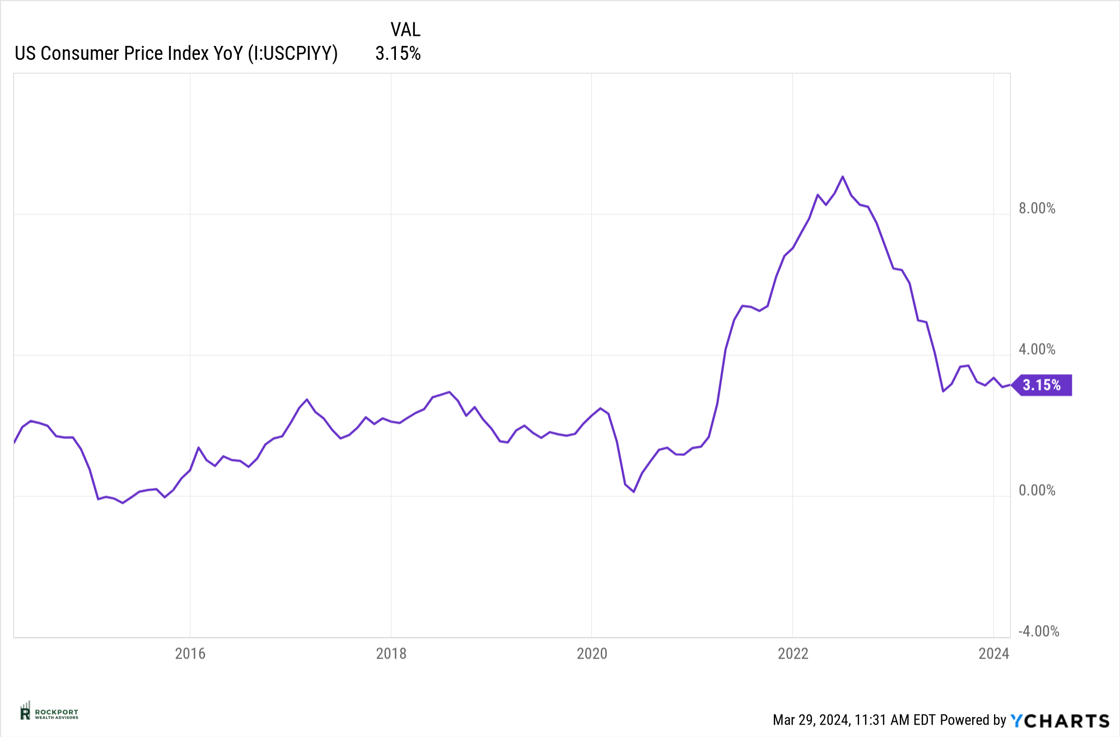

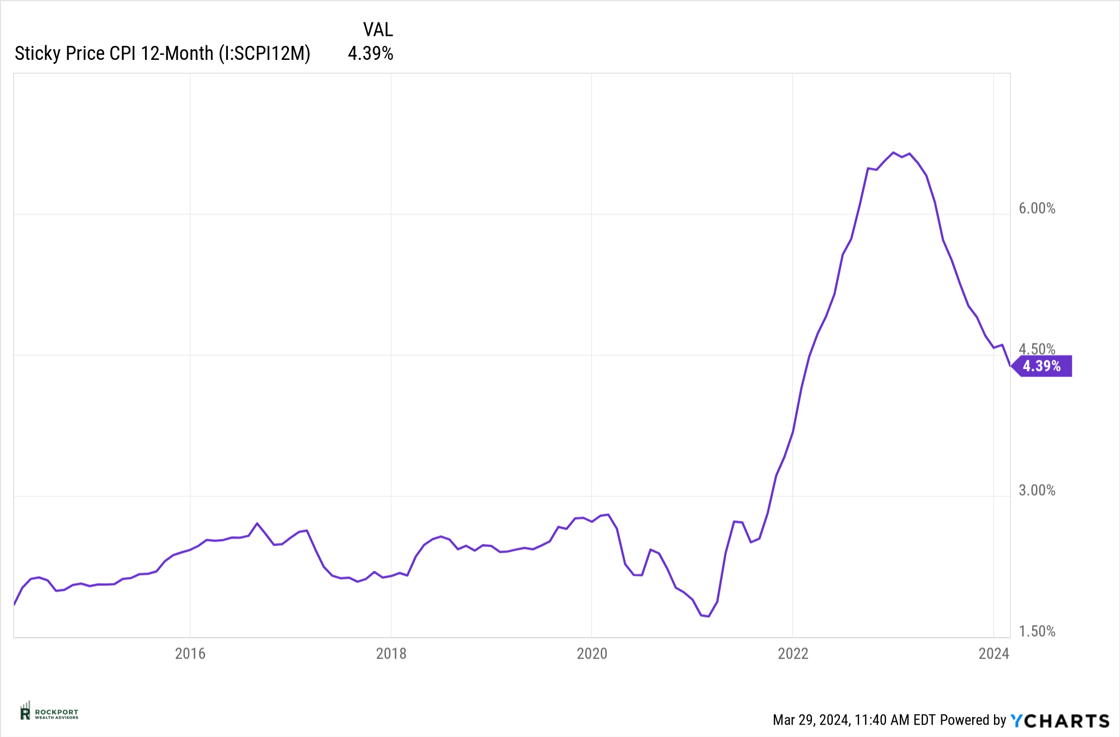

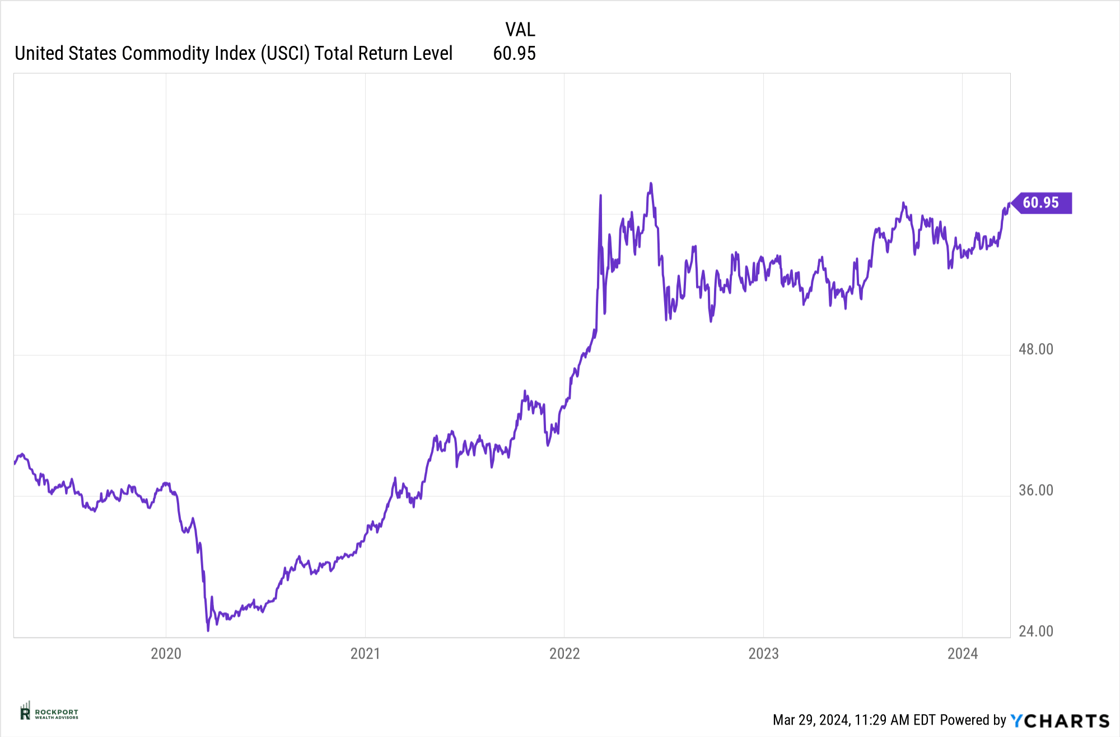

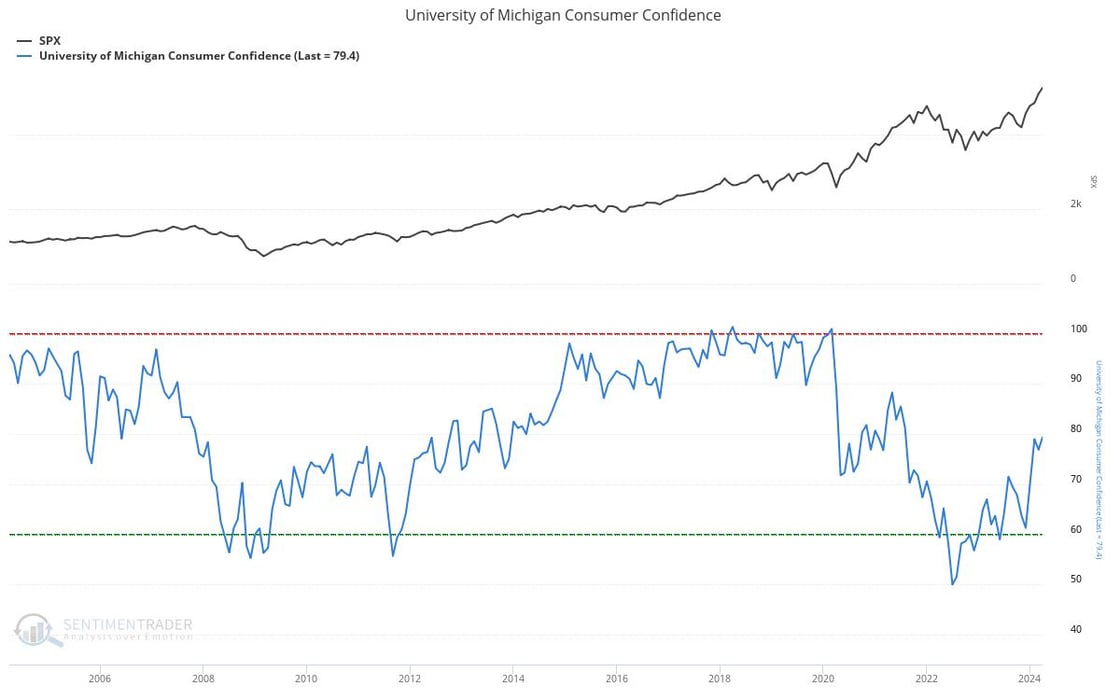

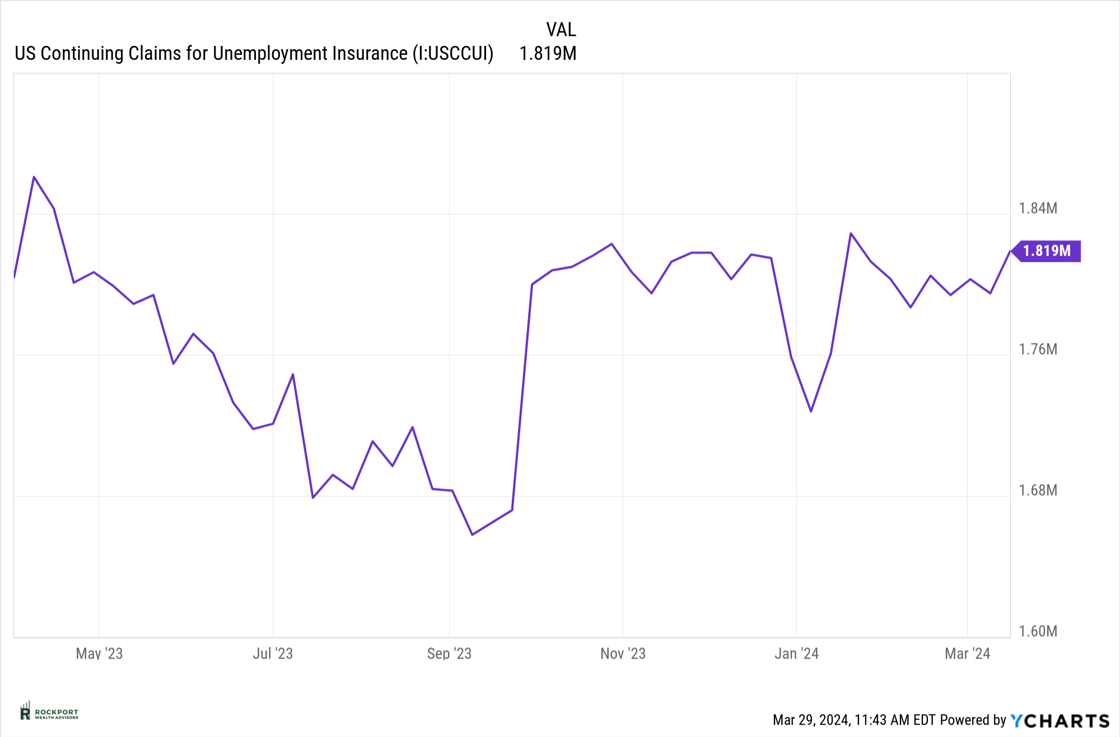

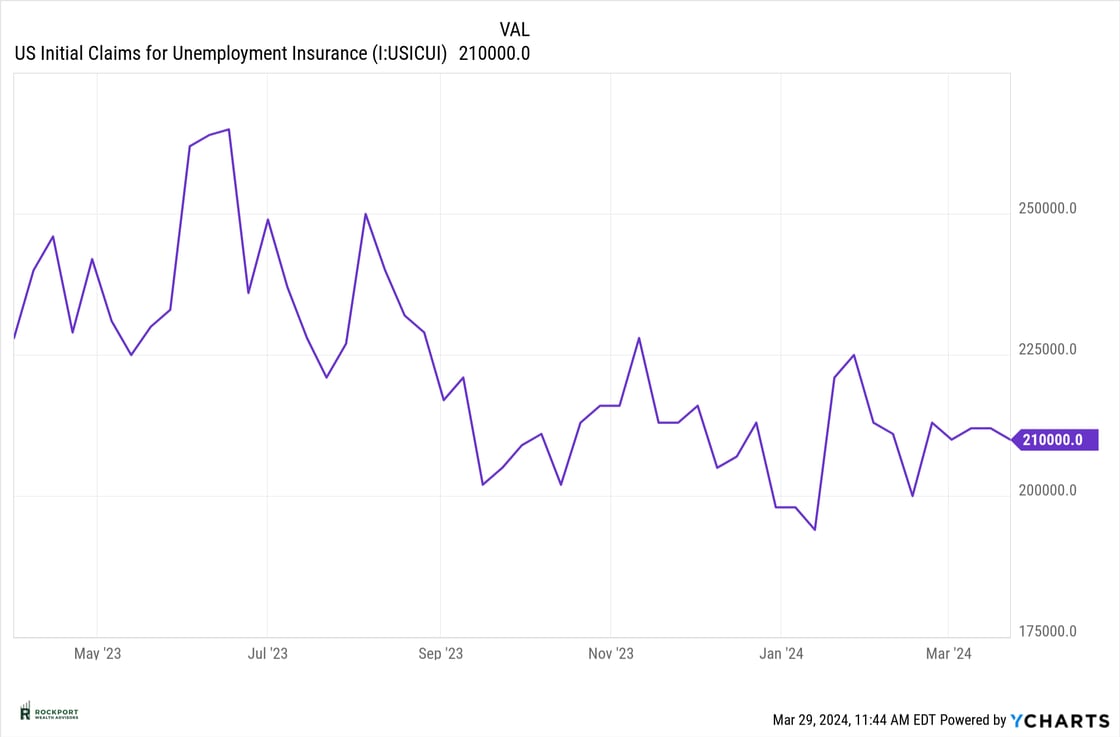

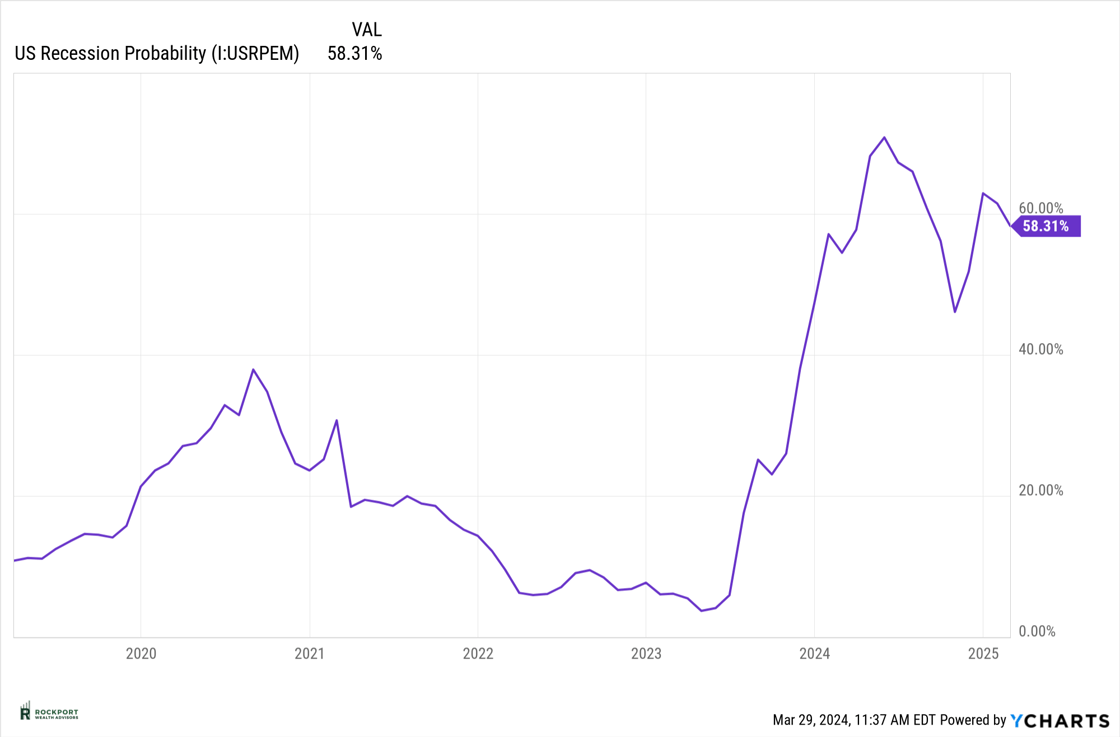

We continue to keep an eye on a few key factors that affect current conditions. Inflation, as measured by the CPI, is still hovering around 3%, while sticky CPI is gradually dropping and now below 4.5%. Commodity prices are on the rise, hitting their highest level since mid-2023, which poses challenges for the Fed’s efforts to control inflation. On a positive note, consumer confidence has seen a slight increase, which is good news. We mentioned last month that significant drops in confidence often precede recessions. Unemployment insurance claims have gone up again, though initial claims have slightly decreased. Finally, the New York Fed’s recession probability model shows a slight drop to 58.31%. There’s still much to consider as we enter the second quarter. |

|

|

|

|

|

|

|

|

Tax Talk Starting in 2024, 529 Plan to Roth IRA Rollovers are now available. Keep in mind:

Example: Joe had been diligently funding a 529 plan for his daughter Aly since she was 1 year old. He stopped funding the account when she reached age 16. Now, after Aly graduated college at age 23 and is joining the workforce, there is still $30,000 left in the account. SECURE 2.0 Act allows Joe to roll over the leftover funds in Aly’s 529 to her own Roth IRA, regardless if her income exceeds the Roth IRA threshold. Note, the amount that can be rolled over each year cannot exceed the annual Roth contribution limit in effect that year, and Aly must have taxable compensation that would otherwise allow her to make a contribution. The 529 plan must have been open for more than 15 years. |

|

As always, if you have any questions on anything we have talked about here or anything else that is on your mind, please feel free to reach out. |

Jon Arnold, Adam Stalnaker and Joe Kovach

|