Jon Arnold’s ViewpointThe Aha Moment For seven months I have been talking and saying that the market is overbought and that it is being manipulated. Evidence of this would be previous newsletters, the radio program and our one-on-one discussions. I purposely held at least 25-50% of your assets in money markets combined with boring sectors such as utilities, health care and pharmaceuticals. The other ½ reluctantly we held in technical equities such as NVDA, and Apple for example. I said reluctantly because I had to position the investors in those because they charged up so fast but in my heart of hearts, I knew a strong pullback was coming. I just did not know when. The beauty of the whole thing is it worked and during this last pullback we did not get destroyed. Even better is now I have “dry powder” available to load when the market bottoms and or there is value buying opportunities in “must buys” at target prices. To close on this point, to say I am proud would be an understatement. We held to our discipline and investing values, and it worked like a clock for the clients. Irrational Investing Take strong note of the past two weeks of your portfolio. Notice that we didn’t get startled or make hasty decisions based on overemotional news about the market. I am pleased to say not one client called our firm like in the past freaking out that the market declined severely. That I must say is a first and more importantly tells me I am doing a good job helping our clients be better investors. This is ultimately my goal. Going forward I want you to expect strong volatility, which usually destroys investors’ thought processes and more importantly their investment accounts. In my opinion we will get this crazy turbulence in the markets until one or two things happen or both. 1. A recession is announced and or 2. Interest Rate cuts are announced and take place. I believe once the interest rate cut comes, the market will stabilize and will probably go back up on its incline. In the meantime, if you can, do not look at your portfolios day to day because it will drive you crazy. However, I believe normalcy is ahead. Our Values and Politics Let me be extremely clear on this. We do Not Insert our Personal Political Beliefs Into our Clients’ Portfolios- Period. The presidency, congress, and the senate have very little to do with the outcome of the market over both long and short periods of time. Also note that I have clients and family that I absolutely love and adore that have the exact opposite political stances as mine. Everyone gets the same treatment at our firm and that is elite service and strategy to the best of my/our ability. I believe over the next three months politics on both sides are going to get more ruthless than it’s ever been, and I need you to know we as a firm and me as an investment advisor will not be participating in the nonsense. On a very personal note, let it be known I have centered myself politically more than ever due to both sides going crazy. It is madness. To close out on this note, no matter who you are, who you pray to, who you share your life with and who you vote for, you are entitled to your opinion and more importantly fair treatment. This I promise you. In closing I hope you are having a great summer and look forward to a beautiful change of leaves. If there are any questions or concerns regarding this update, please do not hesitate to call. |

Client Only WebinarDefinitely hop on this if you can. We had an amazing response to the last one. Very informative. The next one is August 20th at 10:00am. We will be discussing current market conditions and our overall outlook. Click below to register. Thank You for your business! Below please find some market analysis from the team at Rockport Wealth Advisors. |

|

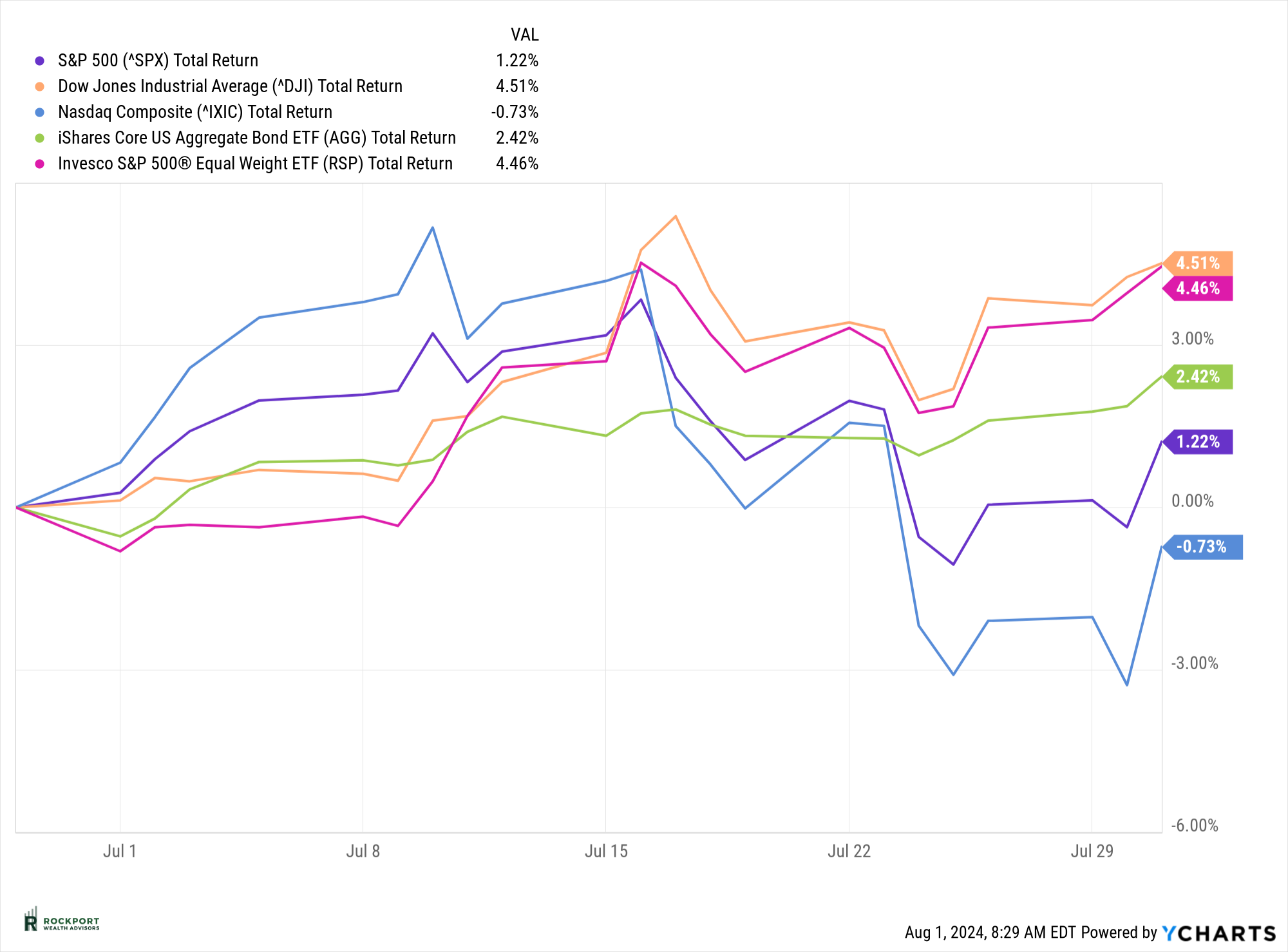

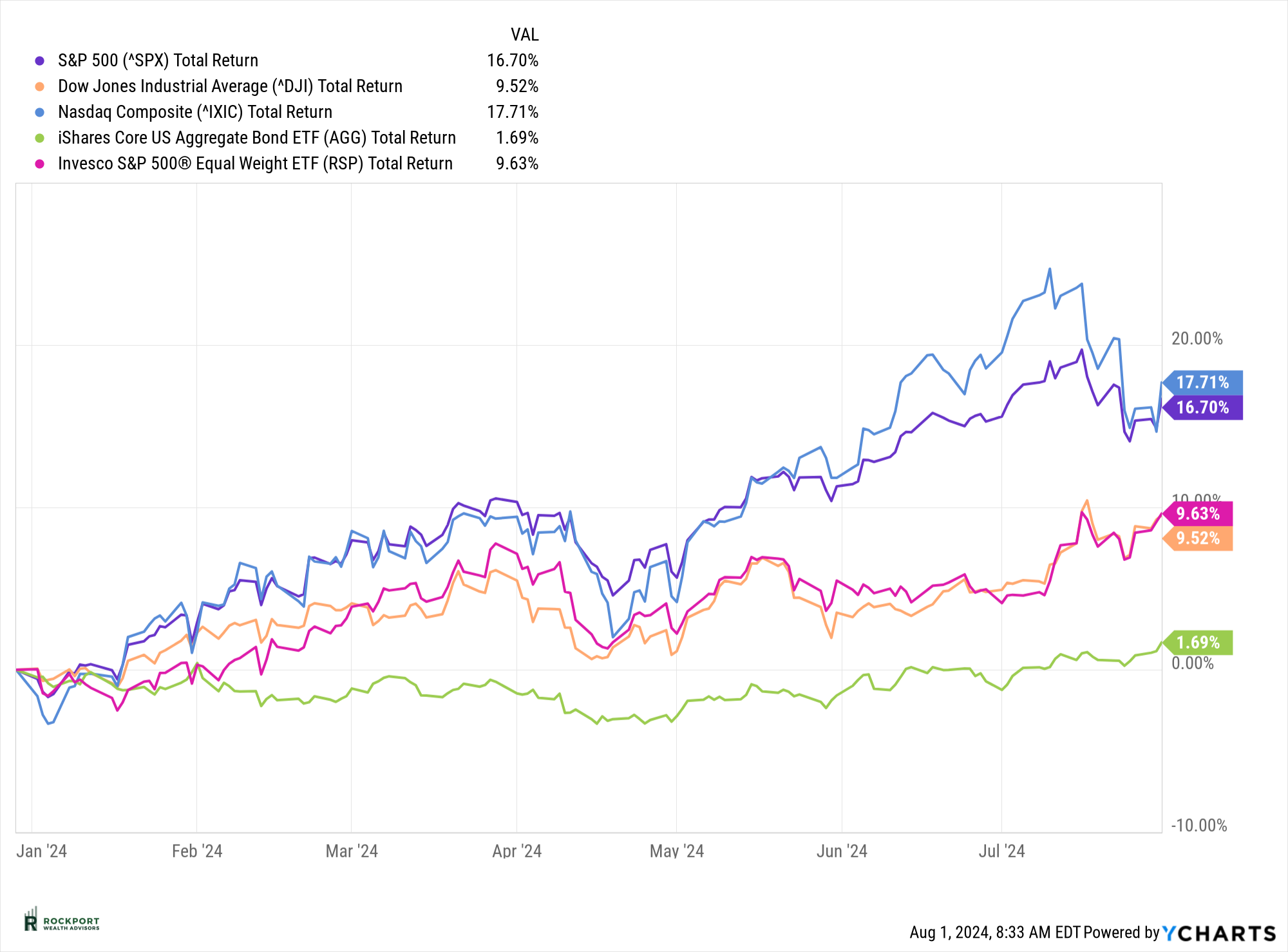

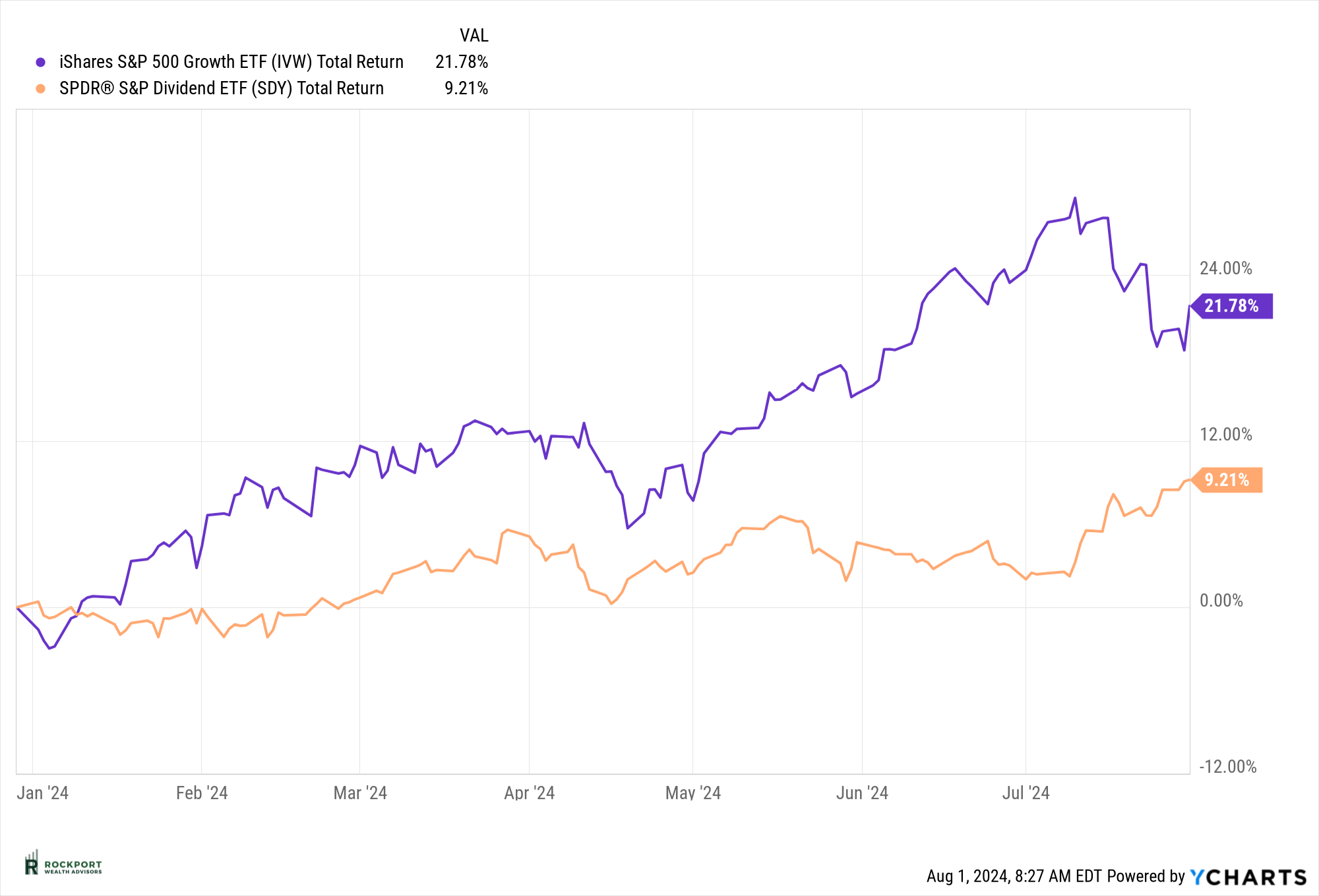

Markets & Economy July was an interesting month for the stock market. The S&P 500 index experienced a modest increase of 1.22%, bringing its year-to-date gain to 16.7%. In contrast, the S&P 500 Equal Weight Index rose by 4.46% for the month, resulting in a year-to-date return of 9.63%. This shift indicates a broadening of market gains beyond the high-tech large-cap growth names to other sectors, a welcome trend signaling healthy broad market participation. However, the month was not without volatility, particularly towards the end. On July 23rd, we witnessed the first day with a decline of over 2% this year, and the first such day since February 2023. This extended period without significant drops is unusual. As a result, it’s reasonable to expect more noticeable intra-day and weekly swings going forward. Despite these fluctuations, it’s crucial to remain composed and not be swayed by sensational media coverage or unqualified opinions on social media. Limiting or eliminating exposure to financial news can be beneficial during such times.

|

|

|

For months, we have noted in this newsletter that economic indicators were not aligning with the continued upward movement in stock prices, which appeared somewhat irrational. This current downturn could be a correction from that irrational buying, possibly accompanied by some irrational selling. It might also be influenced by the traditionally negative sentiment surrounding August and September. Regardless of the cause, it’s remarkable how quickly market psychology can shift from excessive optimism, as mentioned last month, to excessive pessimism. We will continue to provide updates as conditions change.

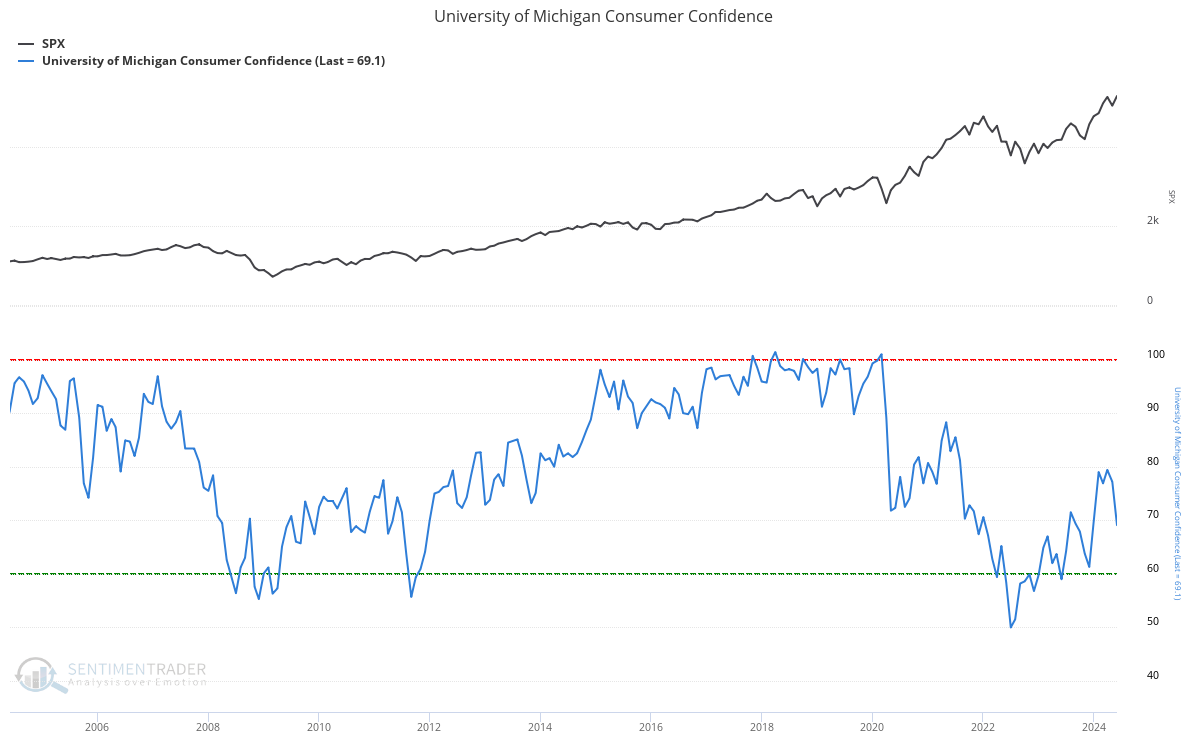

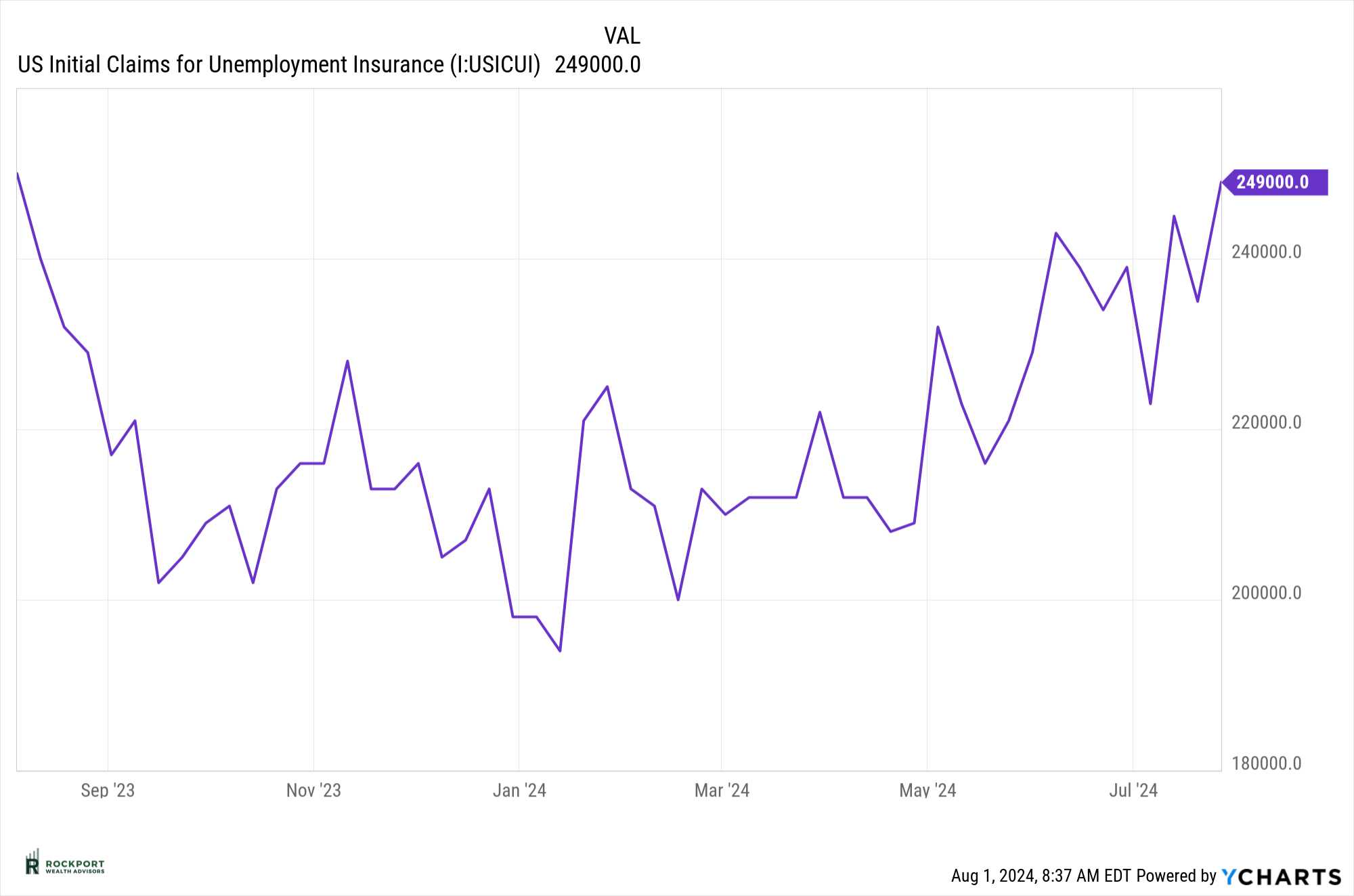

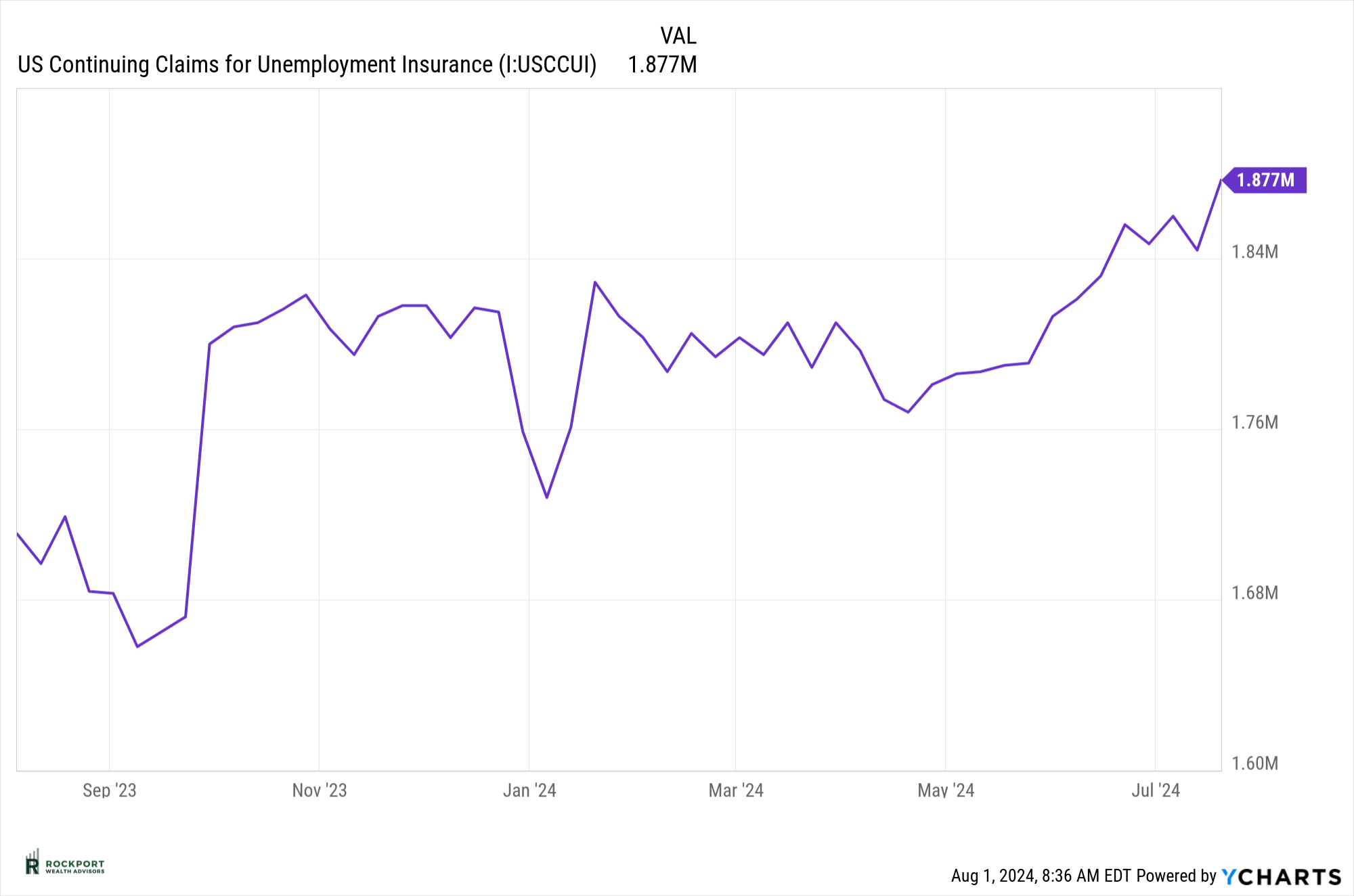

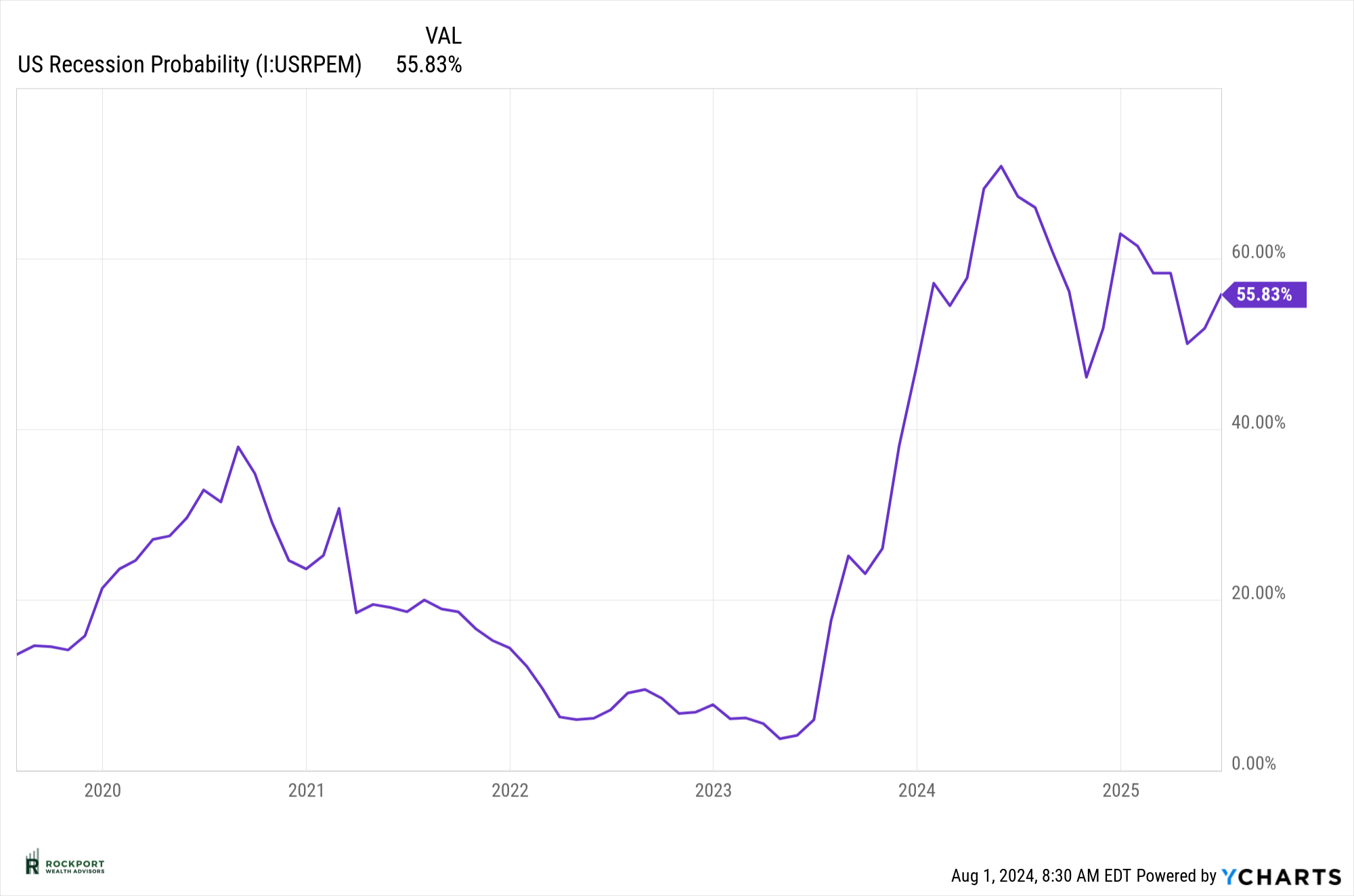

Regarding our recession watch, the likelihood of a recession has increased. At the very least, an economic slowdown is imminent. The New York Fed’s recession probability index has risen to 55.83%. Consumer confidence has slightly decreased, and although the employment situation is not dire, it has weakened again. Both continuing and initial unemployment claims are on the rise.

|

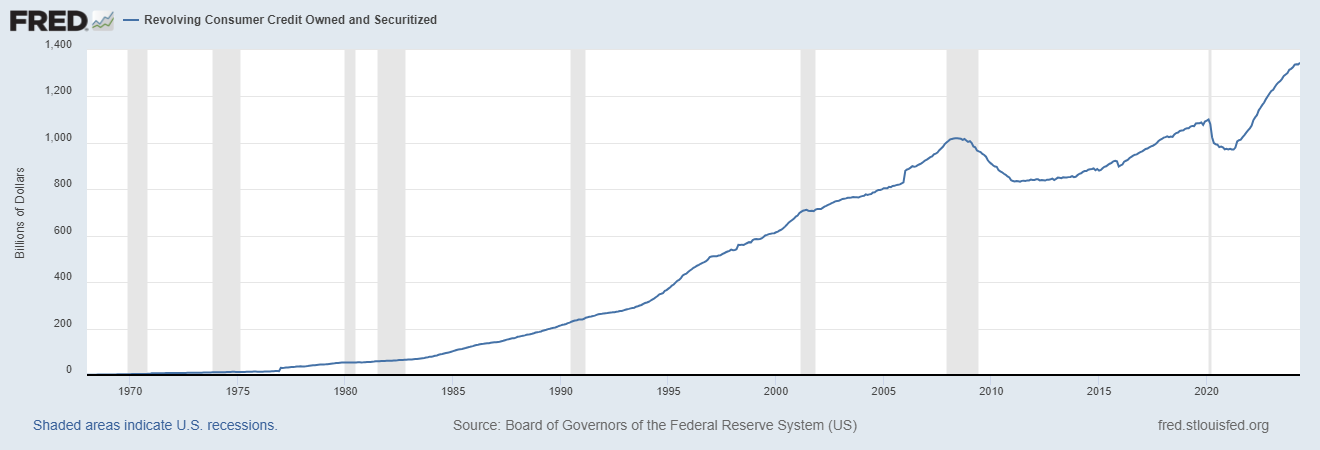

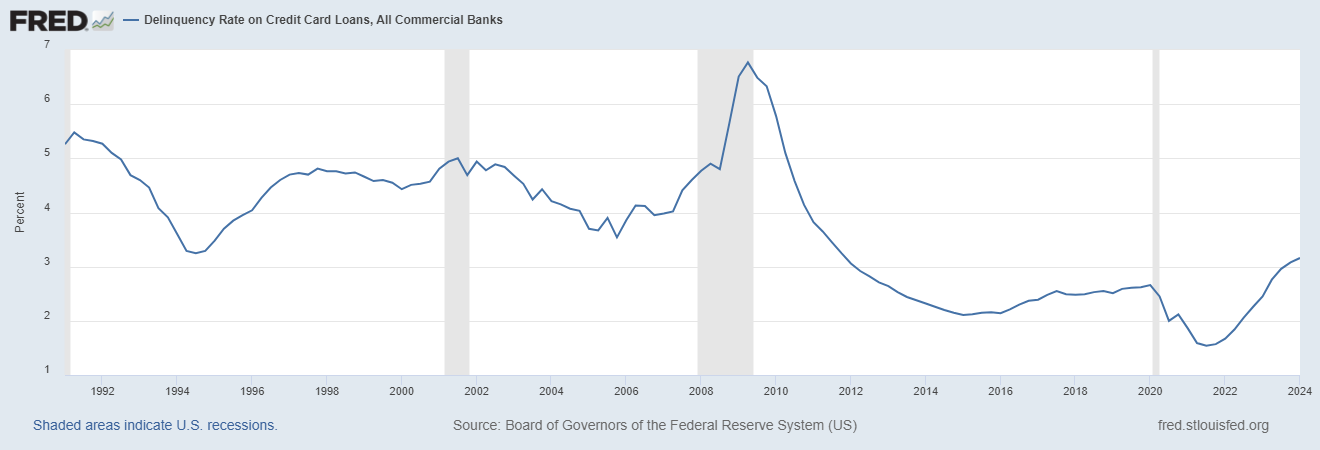

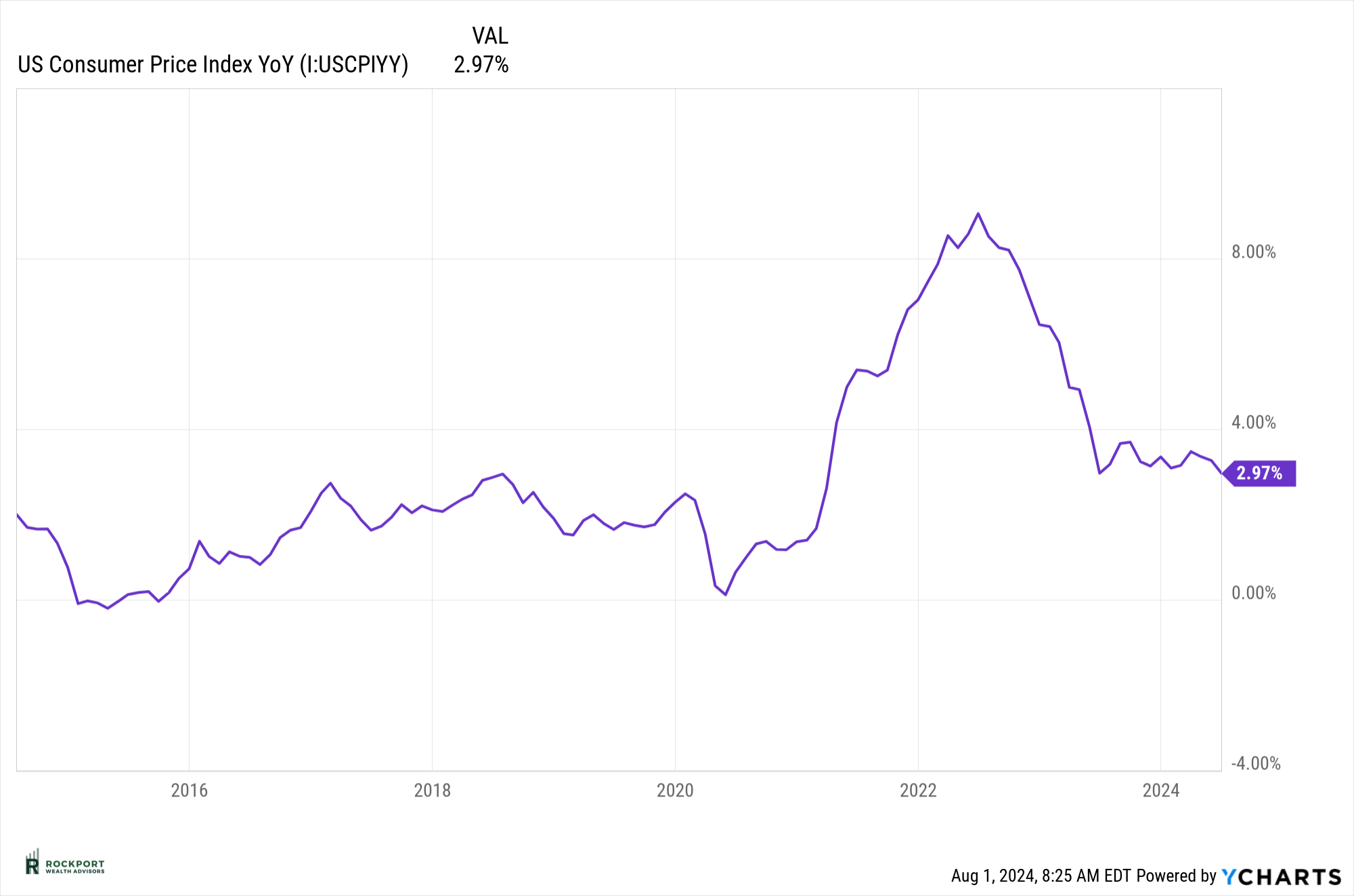

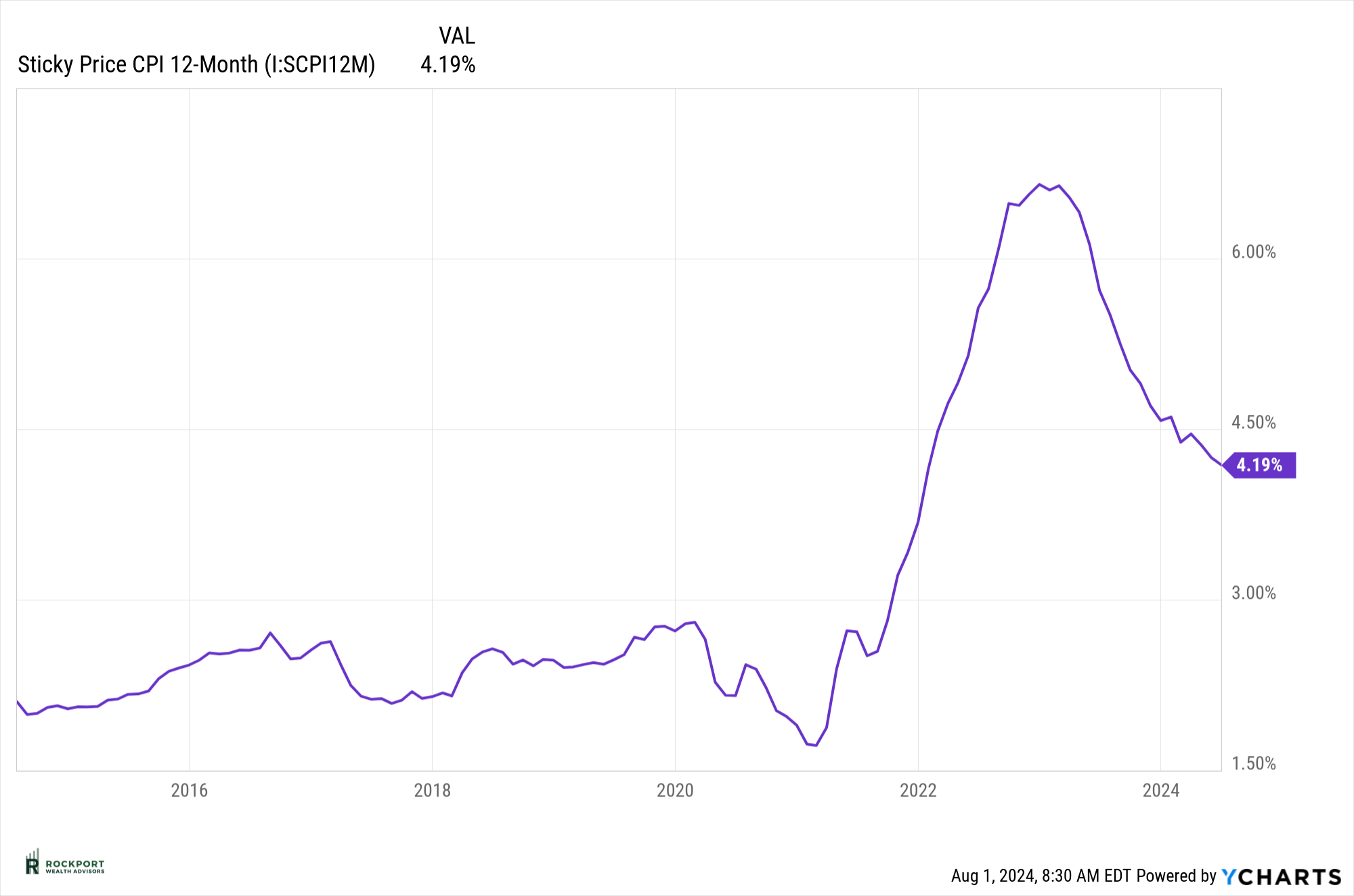

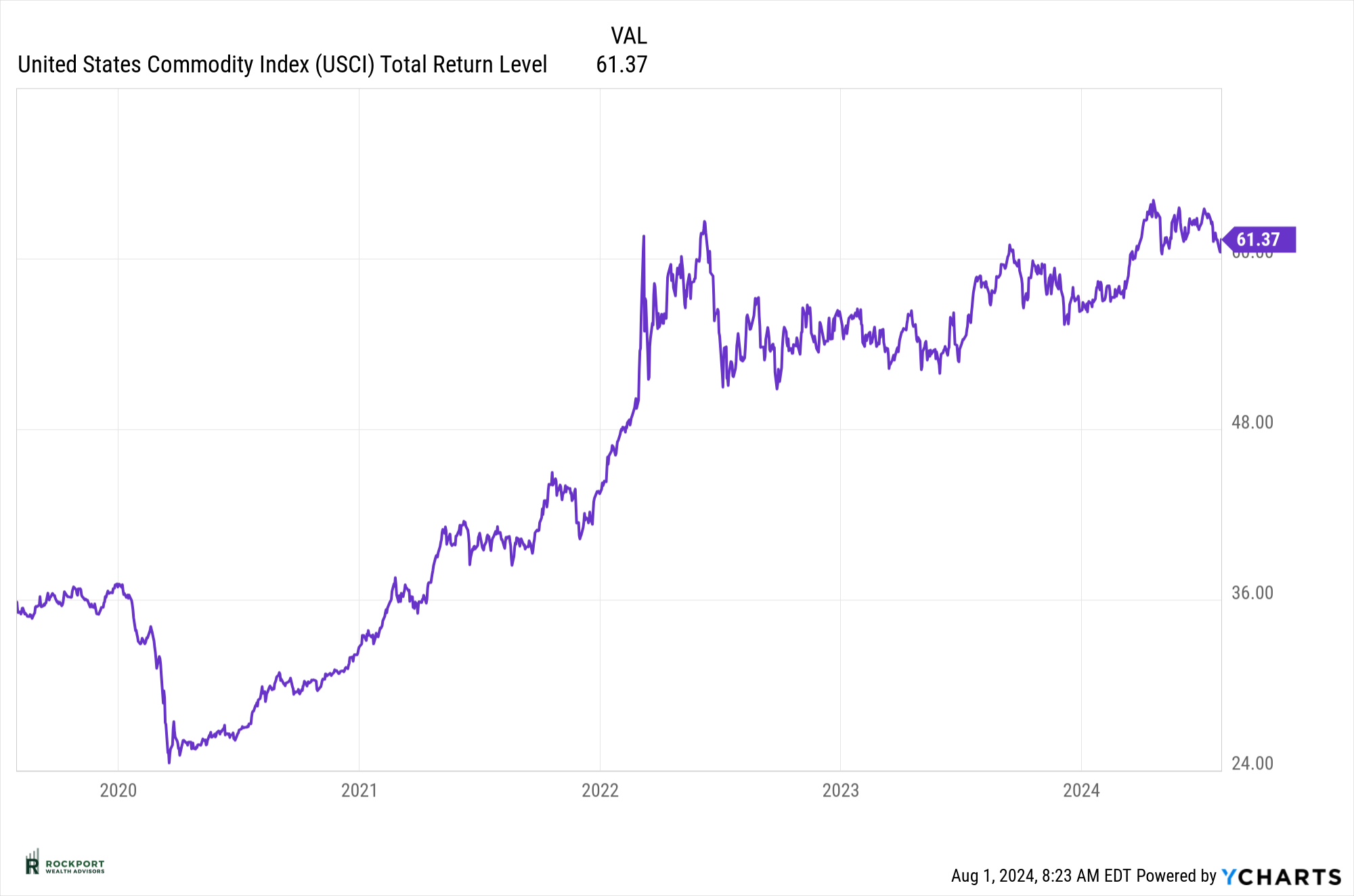

As we’ve highlighted many times, consumer strength is crucial in avoiding recessions. Currently, consumers are showing signs of slowing down and, in some cases, stress. Credit card balances remain at all-time highs, and default rates on these cards and other loans are at their highest level since late 2011. This will be a key area to monitor in the coming months. There is some good news on the inflation front: the Consumer Price Index (CPI) has dropped below 3% for the first time since 2021. This is a positive development, and we hope that consumer prices will continue to moderate in the coming months, especially as commodity prices have also declined. After more than two years of frequently discussing inflation, we will make this our final mention for now. We will continue to monitor this data internally, and if inflation shows signs of rising again, we will revisit the topic with updated charts. For now, we are putting this issue to rest, hopefully for an extended period. |

|

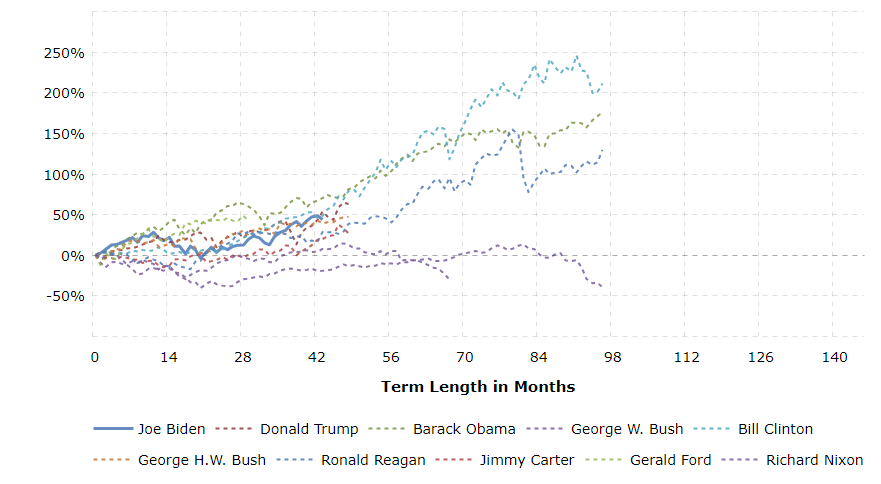

Lastly, with this being an election year there are a lot of questions. One common phrase is that if XYZ person gets elected the markets are going to tank. As you can see in the chart below, the stock market has had success under both parties and a long line of presidents. The only two presidents in modern times that had the stock market fall during their terms were Richard Nixon and George W Bush. So, let’s not assume a given outcome in the election will dictate future investment or that this time is different.

|

|

|

As always, if you have any questions on anything we have talked about here or anything else that is on your mind, please feel free to reach out. |